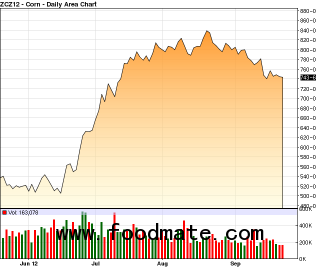

Grain and oilseed markets are being pressured by a lack of confirmation of fresh export demand and increased supplies from harvests. The markets have slumped for much of the past week after jumping to record highs over the summer as a drought battered crops in the Farm Belt.

"The markets are still in a liquidation phase, with speculative funds continuing to reduce risk exposure," said John Kleist, senior analyst with E-bottrading.com in McHenry, Ill.

Corn, wheat and soybean futures all initially drew support Tuesday from technical buying associated with perceptions that the markets had been oversold in recent sessions.

However, selling by farmers taking advantage of relatively high crop prices turned corn and wheat futures lower, and soybeans settled just modestly higher. The U.S. corn and soybean harvests are moving at a record pace for this time of the year.

The U.S. Department of Agriculture said Monday that 39% of the nation's corn crop and 22% of the soybean crop had been harvested through Sunday, up 13 and 12 percentage points, respectively, from a week earlier. The corn harvest is well ahead of its usual pace. The five-year average for this time of year is for 13% of the crop to be completed.

Anecdotal reports of better-than expected yields from early harvests added to the negative tone in markets Tuesday, with traders acknowledging the near-term supply pipeline will be amply stocked in the weeks ahead.

Wheat futures led the declines across the grain sector, amid sluggish demand for it at recent high prices.

Wheat for December delivery dropped 5 1/2 cents, or 0.6%, to $8.86 1/4 a bushel at the Chicago Board of Trade.

Kansas City Board of Trade December wheat dropped 2 1/4 cents, or 0.2%, to $9.11 a bushel. MGEX December wheat finished down 8 1/4 cents, or 0.9%, at $9.42 1/4 a bushel.

Corn for December delivery slipped one cent, or 0.1%, to $7.43 3/4 a bushel.

Soybeans received a boost from buying by end users such as food processors, world importers and livestock feeders, which sought to take advantage of cheaper prices this week. Soybeans had declined in five of the last seven trading days, and were down 10% from their record intraday high of $17.94 3/4 on Sept. 4.

Soybeans for November delivery rose 1 1/2 cents, or 0.09%, to $16.11 1/4 a bushel at CBOT.