Chinese companies are edging out U.S. players in the global dairy industry, according to a recent report from Rabobank.

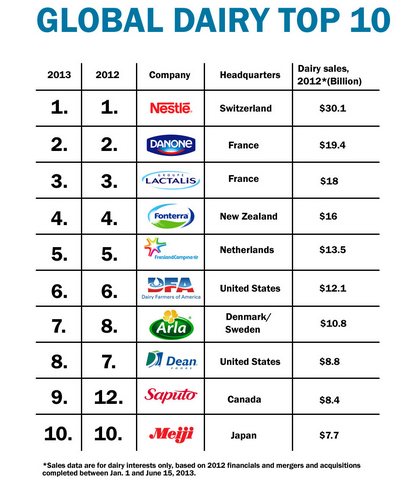

Slow organic growth has pushed consolidation across the industry, with 19 of the top 20 dairy companies buying or selling businesses, engaging in joint ventures or changing capital structure within the past 18 months. Organic expansion and acquisition have kept the top five companies, led by Vevey, Switzerland-based Nestlé S.A., in dominant spots since 2007.

But dropping down the rankings are U.S. companies, stunted by limited global growth and a lack of sizeable acquisitions. Kraft Foods slipped out of the top 10, down seven spots since the split of its U.S. grocery business from Mondelēz. Dean Foods Co. fell one spot following the spin-off of WhiteWave and the sale of its Morningstar business to Montreal-based Saputo, which debuted in the top 10 this year. Additionally, Dairy Farmers of America was among several companies to see sales declines in 2012.

Meanwhile, Chinese companies, such as Yili and Mengniu, have risen in the top 20 rankings, where there were none five years ago.

“With the rapid growth of the Chinese giants, it is quite possible that the U.S. dairy giants will be pushed further down the list in coming years, with the global landscape largely being shaped by others at present,” said Tim Hunt, a Rabobank analyst. “Size should not be a goal in itself, and U.S. companies can participate in growth offshore by developing their export businesses. However, with much of the growth opportunities in dairy likely to come outside of the U.S. in coming years, U.S. companies will need to think about whether being an unaligned exporter with no offshore footing will be enough to secure a fair share of the growth and value available in the future.”