Due to the lack of data on China's corn acreage, USGC doesn't estimate China's total corn crop. But based on yield samples from fields in the major growing areas, USGC expects the 2012 harvest to rise about 5 to 6 million metric tons above the 2011 record, or about 3 percent.

That's roughly in line with USDA's estimates, which call for 200 million tons this year after 192.8 million tons last year.

USGA, which promotes U.S. feed grains around the world, hosted about 30 market analysts, government officials, Chinese feed processors and U.S. farmers on its sixteenth annual China tour September 10-28. USGC, which has been active in China for 30 years, also visited Chinese cornfields earlier in the year to check on planting and early growing conditions.

During the September tour, they evaluated about 300 field samples from China's two main corn regions: the Northeast, which is north of Korea, and the North China Plain, which generally is the area around and south of Beijing. After returning to the United States, USGC members discussed the tour at a Washington news conference.

The tour used customary yield-estimating procedures of counting row spacing and plant spacing, along with rows per ear and kernels per row. Because of the sensitive nature of working with China's government and industry, the USGC has not released yield data. But Michigan farmer Ed Breitmeyer reported surveying fields in northeast China that produced 18,000 to 22,000 plants per acre, with a few up to 25,000.

Overall, the corn growing season was good, with few problems that impacted yields. The tour took pictures of tall green corn that was completely laid over by typhoons in August. But because the stalks didn't break and because 70 to 90 percent of China's corn is harvested by hand or small machines, the corn was salvageable. Armyworms and other pests were also reported in China's crop, with minimal impact.

China's northeast region produces just under 40 percent of the country's corn, and is similar in nature to the northern U.S. Corn Belt, says USGC CEO Tom Sleight. This past spring, it saw a slight increase in corn and peanut acres at the expense of soybeans, he said.

To the southwest, the North China Plain is similar to the western Plains, says Sleight. This plain of rich soil deposited by the Yellow River produces about 40 percent of China's corn crop. Corn and peanut acres increased there too this year, at the expense of cotton.

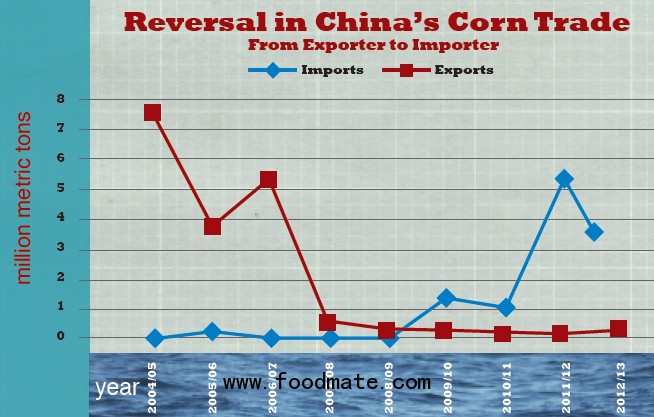

USGC has been touring China's cornfields since 1996, when China was a major corn exporter. But thanks to growing demand for meat from a wealthier urban middle-class, China keeps its corn at home to feed to livestock (mostly hogs and poultry) and for its expanding dairy sector. China also imports corn, and USGC predicts modest imports in the coming year, possibly to maintain reserves. USDA agrees, pegging China's corn 2012-13 imports at 2 million metric tons, down from 5.3 million last year. USDA sees a modest buildup in China's corn carryover from 59.6 million tons this September to 60.2 million tons by next September.

USDA pegs China's corn exports this year at 200,000 tons, or about 8 million bushels -- twice the level of the year just ended in September.

The U.S. has long supplied corn to China, but this year Beijing is looking at Ukraine, where production is expanding. According to industry reports, China has extended a line of credit that Ukraine can use to invest in crop production and export infrastructure. Ukraine is to repay the $3 billion credit with corn shipments to China. The 15-year agreement reportedly came this fall, and could lead to Chinese imports of Ukrainian corn within the year, according to U.S. trade sources.

Overall, USGC sees China's corn situation as a positive for the long term. That's because with a record crop and modest imports, China will have enough corn for continued expansion of its corn-processing facilities. That bodes well for long-term demand, says Sleight. "In a tough year for U.S. corn, it's a relief that the world's no. 2 producer (China) is having a good year. That will help limit demand destruction and preserve markets for U.S. corn as we rebound next year," he said.

This year, only slight growth is expected in China's feed demand and industrial corn processing, due to tight profit margins. But USGC sees demand picking up later as corn prices retreat from this year's record highs. Industrial corn usage in China is projected to grow by 2 to 4 percent in 2012-13, says USGC.

Feed demand, growing sluggishly this year, is forecast to expand by about 4 percent per year over the next five years. And China's demand for dried distillers' grains is projected to grow about 6 percent a year over that same period, says USGC.

USGC recently co-hosted a major hog conference in China with the U.S. Meat Export Federation. China recently lost a part of its hog herd to disease, and the country is rebuilding its live supplies. Some of that rebuilding is copied on the U.S. model of large industrial operations, which will expand China's need for corn.

Overall, China uses nearly 70 percent of its corn crop for domestic feeding. In contrast, only about 41.5 percent of the 2012 U.S. corn crop is expected to go toward U.S. livestock.

Meanwhile, as of its October supply-demand report, USDA seemed a little bit more optimistic than USGC about China's corn consumption. (Perhaps USDA will revise down its figures later in the year.) According to USDA's October estimate, China's total domestic corn usage is seen rising 6.9 percent in 2012-13 significantly larger than the 3.75 percent increase in the harvest.

In contrast, the U.S. has definitely seen "demand destruction" in corn. With shrinking livestock herds and shuttered ethanol plants, USDA projects a 7.3% drop in U.S. domestic corn consumption this year over the already-depressed levels of last year. That doesn't include the 25.5% drop expected in U.S. corn exports.

Bryan Lohmar, who represents USGC in Beijing, expects China to watch the world corn market closely and book sporadic imports on any dip in prices. Just ahead of harvest, Beijing released corn from government reserves, in an effort to keep down food inflation. Lohmar expects China to use price dips to book foreign corn to restock those reserves.

In order to be ready for inflation or a poor crop, Beijing carries much more corn in reserve than the U.S. does, and it will import corn in order to maintain those reserves. USDA estimates that China's corn carry-in and carryout will both be over 1.5 billion bushels this year. That's far above U.S. carry-in this September of 988 million bushels and U.S. carryout next September of 619 million bushels.