Projected Prices in 2013

Projected prices are used to set crop insurance guarantees. These prices are based on settlement prices of Chicago Mercantile Exchange (CME) contracts during the month of February.

The December contract is used for corn and the November contract is used for soybeans. These projected prices will have large impacts on risks farmers face during 2013. Higher projected prices will cause crop insurance products to offer more downside risk protection.

During the first half of February, settlement prices would result in a $5.73 projected price for corn. This $5.73 price is near the $5.68 price level for 2012; hence, the 2013 projected price likely will provide similar protection to that offered in 2012.

During the first half of February, settlement prices would result in a $13.01 projected price for soybeans. This $13.01 projected price is $.46 higher than the 2012 projected price of $12.55. Hence, the 2013 price likely will provide more risk protection for soybeans than the 2012 projected price.

Price Ratios

Market prices provide some guidance for 2013 planting decisions. Higher soybean-to-corn price ratios tend to indicate that soybeans are more profitable to plant than corn, and vice versa. Based on CME settlement prices during the first half of February, the soybean-to-corn price ratio is 2.27.

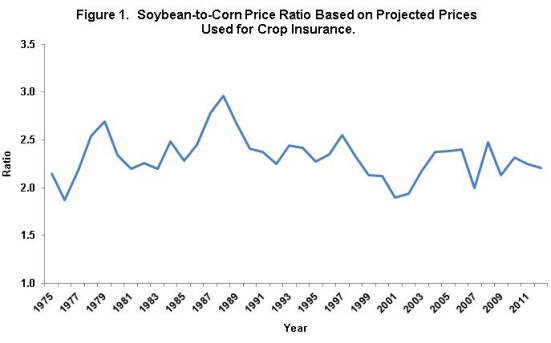

From a long-run historical perspective, the 2.27 is below average (see Figure 1). From 1975 through 2012, the average soybean-to-corn price ratio based on projected prices is 2.32. Hence, from a longer-run historical perspective, the soybean-to-corn price relationship favors corn production compared to soybean production.

However, the 2013 soybean-to-corn price ratio is near the 2007 through 2012 average. Since 2007, the soybean-to-corn price ratio has averaged 2.22. Hence, the 2.27 for 2013 is slightly above the 2.27 recent average, suggesting 2013 prices slightly favors soybean production.

The 2.27 soybean-to-corn price ratio also is not the lowest that have occurred (see Figure 1). There have been four years in which the price ratio is below 2. These occurred in 1976 (soybean-to-corn price ratio of 1.87), 2001 (1.90), 2002 (1.94), and 2007 (1.99).

Projected versus Harvest Soybean-to-Corn Price Ratios

A natural question is: Will a low soybean-to-corn price ratio based on the projected prices result in a low ratio in the fall and vice versa? If it does, there can be more confidence in making planting decisions on current price relationships.

This question is examined by calculating the soybean-to-corn price ratios based on the harvest prices, and then comparing harvest price ratios to projected price ratios. Harvest prices are based on October settlement prices, thereby reflecting price relationships during the fall.

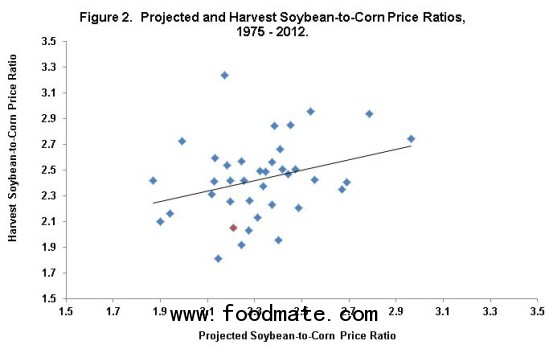

Figure 2 shows a scatter of yearly price ratios based on projected and harvest prices. In 2012, for example, the soybean-to-corn price ratio based on projected prices is 2.21 ($12.55 soybean projected price / $5.68 corn project price). Harvest prices result in a 2.05 ratio ($15.39 soybean harvest price / $7.50 corn harvest price). In Figure 2, the 2012 ratio is denoted by a red dot.

There is a positive correlation between projected and harvest price ratios of .30. Lower projected soybean-to-corn ratios tend to be associated with lower harvest price ratios. However, the correlation is not strong. A low projected price does not always result in a low harvest ratio.

For example, the 2007 projected soybean-to-corn price ratio of 1.99 is very low. However the 2007 harvest price ratio of 2.72 is above average. For the four years with price ratios below 2.0 (1976, 2001, 2002, 2007), the harvest price ratio averaged 2.35, above the 2.32 average of projected ratios from 1975 through 2012.

The low correlation calls into question basing planting too much of current price relationships. Often, price relationships change between spring and fall, altering final income from crops. Longer run rotational considerations likely should play a large role in planting decisions.

Summary

Settlement prices during the first half of February suggest that the 2013 projected price for corn will be near 2012 levels and the projected price for soybeans will be above 2012 levels. Crop insurance products will provide roughly the same risk protection in 2013 as they did in 2012.

Compared to 2012 prices, 2013 prices are slightly more favorable to soybean production. The soybean-to-corn price ratio in 2013 is projected to be higher than in 2012. Large corn plantings are projected. It will remain to be seen if farmers react by planting as much corn as is projected.