Coca-Cola, the world’s most valuable brand, is losing its fizz as low-cost rivals and retailers’ private-label brands increase their share of soft drink sales.

Private-label soft drink and bottled water sales rose 19 per cent last year, almost four times the growth in the non-alcoholic beverages category, and account for 10 to 15 per cent of volumes in supermarkets, according to Nielsen and Credit Suisse.

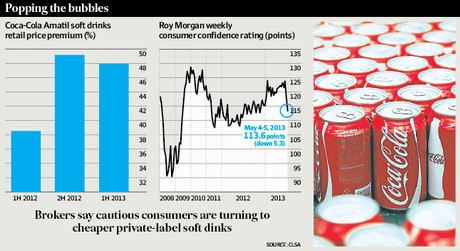

Brokers believe the growth in private-label beverages is one of the factors behind Coca-Cola Amatil’s surprise profit downgrade on Tuesday.

Credit Suisse says Coca-Cola Amatil’s leading brands have been losing share for 18 months to private-label beverages as consumers seek better value in grocery stores.

Private-label soft drinks also set the price benchmark for second tier brands such as Pepsi, which is bottled bySchweppes. Schweppes has been discounting to promote the low-sugar Pepsi Next and to boost volumes after a tough year last year, when it was hit by industrial action and short supplies of carbon dioxide.

PRICE GAP BLOWOUT

At the height of the discounting, the price gap between Pepsi and Coca-Cola blew out to about 50 per cent, denting sales of Coca-Cola.

According to Nielsen, soft drink volumes grew 4 per cent in the March quarter, but CCA’s volumes fell about 2 per cent and its market share is estimated to have fallen two points.

Brokers such as Credit Suisse and CLSA say Coca-Cola Amatil needs to address the pricing disparity by reducing prices, while other brokers say that as the market leader, Coca-Cola still has the power to set market prices.

“For years now [CCA] has pushed up pricing in an effort to keep profit growth momentum,” said CLSA analyst David Thomas. “It’s not surprising that competitors look to attack in this area.”

Mr Thomas said Australian consumers were paying more for Coca-Cola than in any developed market, echoing concerns by Coles managing director Ian McLeod aired on Financial Review Sunday.

A two-litre bottle of Coke cost 40 per cent more in Australia than in Britain, while a 24-can pack costs 60 per cent more. At Wesfarmers’ Coles, private label “Smart Buy” cola costs 72¢ a litre, one-third the price of Coca-Cola and less than half the price of Pepsi. However, CCA says there are different cost structures in every market, so comparing prices is meaningless.

LOWER PRICES THE ANSWER

Credit Suisse analyst Larry Gandler says Coca-Cola Amatil may have to reduce average retail prices by 10 to 20 per cent and reduce costs by $30 million to $60 million to protect its market share and maintain earnings.

“We see no other solution but to invest in price – perhaps over many years,” Mr Gandler said.

Coca-Cola Amatil chief executive Terry Davis has played down the threat to Coca-Cola from private-label soft drinks,saying home-brand beverages compete more with Pepsi.

Furthermore, CCA says private-label accounts for 10 per cent of supermarket soft drink volumes but only 4 per cent of sales by value and are flat this year.

“Private-label soft drinks generally compete against Pepsi and when Pepsi prices go down, private-label demand goes down. When Pepsi prices go up, private-label goes up,” Mr Davis said after Tuesday’s profit downgrade.

Mr Davis has also rejected suggestions that Coca-Cola Amatil's costs are too high.