McDonald's new "Practical Money Skills Budget Journal" makes it glaringly obvious that it's almost impossible to live off the low wages the fast-food chain pays its employees.

Together with Visa, McDonald's published the log to help employees tally their monthly expenses and budget accordingly. But the assumptions of what basic necessities like heat, healthcare, and food cost per month are ridiculous.

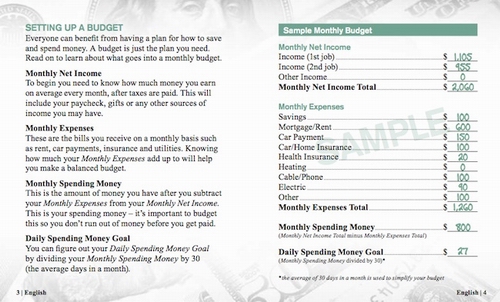

First of all, the handbook assumes a monthly income of $1,105 from a person's "1st job," which is calculated off a 35-hour week schedule. It also lists a second income of $955 per month from a "2nd job" that requires another five to six shifts a week.

"Once the employee is working 75 to 80 hours a week, it’s a relatively simple matter of budgeting," Gross writes. "Some of the lines sound reasonable: $600 a month for rent, $100 a month for car and home insurance, $100 a month for cable and phone. But some of the suggestions are banoodles. Presumably these employees must all live in Hawaii, because the suggested monthly cost of heating is... zero. The line for health care is $20 a month, which is enough to pay for a bottle of aspirin — and a couple of days of health-insurance coverage each month."

McDonald's and Visa also apparently assume that a person on this fantasy budget need not eat, as there is no line for groceries or food. Gross thinks the journal is "clueless and more than a little condescending."

"People who live on chronically low incomes know all about budgeting. And the best way to improve employees' financial standing doesn’t require the construction of a Web-based tool," he wrote. "Employers just have to pay them a little more."