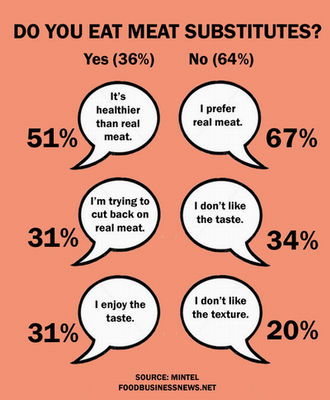

More than a third of consumers eat meat substitutes, but only 7% identify as vegetarian, according to a recent report from market research firm Mintel.

Why are carnivores swapping swine for soy? Health perception, suggests Mintel. More than half of consumers who eat faux meat believe it’s better for you than the real deal.

“While meat alternatives have the potential to meet a range of consumer needs, targeted health positioning has the potential to attract the specific attention of consumers,” said Beth Bloom, food and drink analyst at Mintel.

Among new products in the meat alternative category, vegan claims surpassed vegetarian claims in 2011, and “no animal ingredients” claims doubled between 2008 and 2012, suggesting a trend in more extreme dietary habits. Also popular were non-bioengineered ingredient claims, which grew 155% during that time.

“While, at one time, products in the category were seen as a substitute for meat consumption, the expansion of formats and flavors has allowed the category to grow beyond one of necessity to become one of desire,” Ms. Bloom said. “Product manufacturers and marketers have a chance to come out from behind the veil of ‘substitute’ and stake a claim as a food option that stands on its own.”

Still, most consumers turn down tofu, whether they prefer real meat (67%), don’t like the taste of meat alternatives (34%) or don’t like the texture (20%).

But of the 36% of consumers who opt for animal-free protein, about a third said they enjoy the taste.

“The bottom line is that vegetarians and vegans aren’t the only people eating ‘fake’ meat,” Ms. Bloom said. “Meat eaters are also exploring this newfound protein superpower.”

Why are carnivores swapping swine for soy? Health perception, suggests Mintel. More than half of consumers who eat faux meat believe it’s better for you than the real deal.

“While meat alternatives have the potential to meet a range of consumer needs, targeted health positioning has the potential to attract the specific attention of consumers,” said Beth Bloom, food and drink analyst at Mintel.

Among new products in the meat alternative category, vegan claims surpassed vegetarian claims in 2011, and “no animal ingredients” claims doubled between 2008 and 2012, suggesting a trend in more extreme dietary habits. Also popular were non-bioengineered ingredient claims, which grew 155% during that time.

“While, at one time, products in the category were seen as a substitute for meat consumption, the expansion of formats and flavors has allowed the category to grow beyond one of necessity to become one of desire,” Ms. Bloom said. “Product manufacturers and marketers have a chance to come out from behind the veil of ‘substitute’ and stake a claim as a food option that stands on its own.”

Still, most consumers turn down tofu, whether they prefer real meat (67%), don’t like the taste of meat alternatives (34%) or don’t like the texture (20%).

But of the 36% of consumers who opt for animal-free protein, about a third said they enjoy the taste.

“The bottom line is that vegetarians and vegans aren’t the only people eating ‘fake’ meat,” Ms. Bloom said. “Meat eaters are also exploring this newfound protein superpower.”