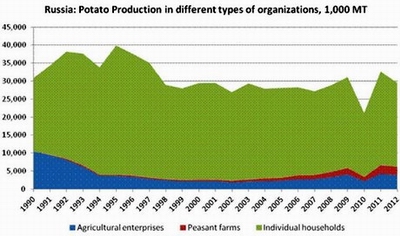

In 2012, Russia produced 29.5 million metric tonnes (MMT) of potatoes. At present only 13 percent of domestic potatoes are produced by agricultural enterprises, with 8 percent produced by private farms, and the other 79 percent produced by households (backyard production).

Potato production is not concentrated in any one area in Russia, although during the past few years, commercial production of potatoes at large agricultural enterprises, private farms in Moscow and in some Western provinces of the Central Federal District have increased.

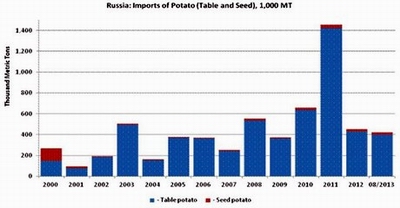

The potato crop in 2013 is expected to be down as a result of excessive rainy weather, especially at harvest. Russia is largely self-sufficient in potato production, and imports of potatoes remain relatively small, and in 2000-2010 it never exceeded 0.6 MMT a year. The highest year of imports was in 2011, when 1.4 MMT were imported after the severe drought of 2010 which decimated Russia’s potato crop. Potato importers are usually larger retail companies that focus on serving customers in large metropolitan areas such as Moscow and St. Petersburg.

Potato production

Since the late 1990s, potato production in Russia has been relatively stable - between 27 and 30 MMT per year.

Production in Russia remains dominated by household (backyard) production, which in 2012 still provided nearly 80 percent of all production. The source of production, though, has shifted gradually towards more production in large agricultural enterprises and private farms.

Increased production at larger scale farms has been driven by growing demand from producers of snacks (chips), other value added potato products, and large retail companies focused on selling high-quality potatoes in urban markets such as Moscow and St. Petersburg. These agricultural enterprises are the ones that are increasingly purchasing modern equipment, using improved seed potatoes, and are able to invest in more modern storage facilities. Agricultural enterprises produce potatoes for processing and for retail sale and some of these enterprises have constructed their own processing facilities, while others sell potatoes to large food (snack) companies.

Source: Rosstat

Potato yields in Russia have been increasing since the early 2000s as a result of the increased production in larger agricultural enterprises. Despite this, average yields still remain below those of developed countries. Even among agricultural enterprises yields can vary significantly, as some have invested in modern equipment and agro-economic practices, while others save on inputs and are more content with modest yields.

Although potato production is spread throughout Russia, production by large agricultural enterprises tends to be more concentrated in the Central and Volga Valley federal districts. This is primarily due to the location of potato processing companies in these areas, as well as their proximity to major urban centres with high levels of food retail outlets.

Crop 2013 Estimate

There is no official estimate of Russia’s potato crop in 2013 and the Russian Ministry of Agriculture follows the potato harvest progress in agricultural enterprises only.

In 2013, the weather was not favourable for the potato crop as a cold and rainy spring in Central European Russia delayed potato planting, impacting yields. Also, very heavy rains in September all over European Russia postponed harvesting, and in some provinces even made machine harvesting impossible (i.e. harvesters could not move in the fields). While the potato harvest is typically over by the end of September, this year it has continued through to mid-October. As of October 28th, 2013, agricultural enterprises harvested 3.4 MMT of potato from 178,600 hectares (which is 93 percent of planted area). This is 17 percent lower than potato production in agricultural enterprises in 2012 (4.1 MMT), and 19 percent lower than in 2011 (4.2 MMT).

There are no estimates of potato production in household backyards and in private farms, and it is possible these smaller farms were not as impacted by the rainy weather at harvest. Assuming this, FAS/Moscow estimates Russia’s total potato production in 2013 at 28.3 MMT, which will be close to the last 5-year average of 28.7 MMT (the average includes the low 2010 crop of 21.1 MMT).

Potato Consumption

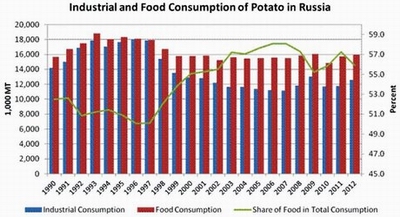

The total consumption of potatoes in Russia has been decreasing in the past two decades, not only due to lower food use, but even more so due to decreasing industrial consumption. Industrial consumption/use of potatoes in Russia reached a maximum of 18.0 MMT in 1996, and the dropped to 11.2 MMT in 2006 and 2007, before recovering somewhat and by 2012 reaching 12.6 MMT annually. While in the first half of 1990s the bulk of industrial consumption of potato was in the form of non-food alcohol, this has shifted dramatically and now more of the industrial use is in value-added food products, mostly snacks (chips).

Food consumption of potatoes reached a maximum of 18.8 MMT in 1993 as the collapse of the Soviet Union, and the severe economic crisis, resulted in higher consumption of a lower-cost source of calories, and one that could be produced by household/backyard farms. After this period, and with the opening up of the Russian economy, greater access to a variety of foods and higher incomes, potato food consumption fell.

Since the beginning of the 2000s, potato consumption has largely stabilized at 15.0 – 16.0 MMT. The Russian Food Security Doctrine has set a target of 95 percent self-sufficiency in potato production in Russian. In 2012, domestic production minus losses accounted for 97 percent of both domestic industrial and food consumption, surpassing this goal.

Source: Rosstat

Although food consumption has remained steady in recent years, there has been a marked shift away from so called “home-use” of potatoes (i.e. direct consumption by households for their own use) and a greater increase in use by restaurant and catering and other outlets. The Russian State Statistical Service (Rosstat) publishes a per capita “home-use” domestic consumption number and it shows dramatic declines during Soviet times, and a more gradual decline in recent years. For example, in metropolitan areas this home-use per capita number has fallen from 109 kg per year in 1980 to only 60 kg in 2012. In rural areas the decline is even sharper and the per capita potato consumption there has decreased from 161 kg in 1980 to 75 kg in 2012. This is primarily due to the availability of a greater range of foods available, and a shift towards more eating outside the home.

Source: Rosstat

Trade in Potatoes

According to Rosstat balances, since 1990 the share of imports in the total supply of domestic potatoes varied from 0.1 percent in 1995 (domestic production was 39.9 MMT) to 2.63 percent and 3.15 percent in 2010 and 2011 respectively (domestic production in 2010 was the lowest since Russia’s independence).

Source: GTA

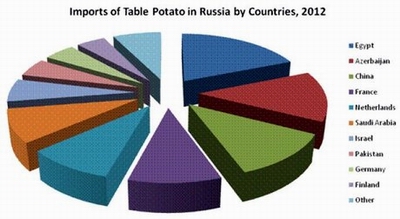

In CY 2012 Russia imported 452,748 MT of potatoes, including 22,095 MT of seed potatoes and 430,652 MT of table potatoes. In the first 8 months of 2013, Russia imported 421,945 MT of potatoes, which is 4 percent less than in the same period last year. However, imports of seed potatoes actually increased by 12 percent to 23,165 MT, compared to the same period last year. In 2012 the major suppliers of table potatoes to Russia were Egypt (81,308 MT), Azerbaijan (58,609 MT), China (51,547 MT), France (42,092 MT), The Netherlands (40,425 MT), Saudi Arabia (38,403 MT), Israel (26,490 MT), Pakistan (21,253 MT), Germany (20,242 MT), and Finland (18,810 MT). These countries accounted for almost 93 percent of total imports. Imports of table potatoes from the United States in 2012 were only 2,251 MT, or 0.5 percent of the total.

Source: GTA

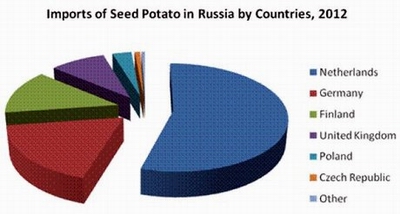

The major suppliers of seed potato to Russia in 2012 were The Netherlands (12,059 MT), Germany (4,012 MT), Finland (2,971 MT), United Kingdom (2,025 MT), Poland (700 MT), and Czech Republic (200 MT).