Palm oil, the world's most traded vegetable oil, typically tracks rival soy oil as both can be substituted for each other. Weaker soy markets could channel some food and fuel demand away from palm as the world's top buyers look for cheaper options.

The U.S. soyoil contract for March fell 1.1 percent in late Asian trade, while the most active May soybean oil contract on the Dalian Commodities Exchange dropped 1.8 percent.

"The market has been a bit depressed over the past few days because of weakness in these external agricultural products," said a trader with a foreign commodities brokerage in Malaysia.

"The actual support is now 2,550 ringgit. But if we have persistent weakness in the U.S. and China markets, then our market has no choice but to follow," the trader added. "Only the ringgit will hamper the market from going down too sharp."

The Malaysian ringgit was trading at 3.2800 against the greenback on Tuesday, having dropped about 0.1 percent since the start of the year. A weaker ringgit attracts buying interest from overseas buyers and keeps prices supported.

The benchmark March contract on the Bursa Malaysia Derivatives Exchange had inched down 1.7 percent to 2,561 ringgit ($781) per tonne by Tuesday's close. Prices earlier toucher 2,558 ringgit, the lowest level since Dec. 20.

Total traded volume stood at 28,972 lots of 25 tonnes, slightly below the usual 35,000 lots.

Technicals showed Malaysian palm oil may end its current downtrend around a support at 2,570 ringgit per tonne, as indicated by its wave pattern and a Fibonacci retracement analysis, Reuters market analyst Wang Tao said.

In other markets, Brent oil futures climbed above $107 a barrel on Tuesday after five consecutive sessions of losses, as investors weighed mixed signals from Libya and as cold weather across the central United States threatened production.

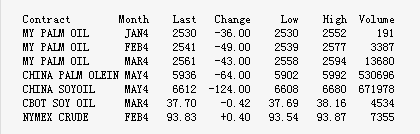

Palm, soy and crude oil prices at 1005 GMT

Palm oil prices in Malaysian ringgit per tonne

CBOT soy oil in U.S. cents per pound

Dalian soy oil and RBD palm olein in Chinese yuan per tonne

Crude in U.S. dollars per barrel