The country with over 17,000 islands also has the largest market share for food and beverages, pharmaceuticals and cosmetics in the ASEAN (Association of South East Asian Nations) region, and accounts for about 51 per cent of the region's total ingredient consumption.

The island country is multi-ethnic with many languages and cultures, wide regional differences, fast-changing political and economic circumstances. However, ongoing modernisation is bringing the lifestyles of Indonesia's urban consumers closer together.

In addition, internationalisation (i.e. huge inflow of people from across the world) is also creating some similarities between consumption patterns in Indonesia and countries like India, although many big differences remain.

Since ages, Indonesia is an important neighbour and key trading partner for India.

In recent times, in particular from past decade, this nation has faced myriad challenges and more indubitably lie ahead. In particular, the economic growth has recovered quite strongly and the nation returned to the top tier of the Indian food and beverage export markets, ranking eighth as the most important export market for Indian agricultural and processed food and beverage items.

As per Apeda (Agricultural and Processed Foods Products Export Development Authority) – the apex body for the promotion of exports of agri-products in India – Indonesia is one of the top ten import destinations for the Indian F&B products. The Ministry of Commerce and Industry under the government of India aims to penetrate deeper into the Indonesian market than Yemen and other African countries.

Further, the scale of our trade relationship is reflected in the large number of Indian companies, big and small, that are represented in Indonesia. Healthy two-way trade and investment ties are an important element in the broader India-Indonesia relationship.

Indonesian food industry

Food processing and economic development go hand in hand. Alongside economic development, as urbanisation and incomes grow and as the pace of life changes, lifestyles alter generating a demand for a variety of processed foods.

In Indonesia, with the recent burgeoning of relatively prosperous urban middle classes the demand for processed foods is bound to grow.

According to the latest industry report, “Indonesia Food and Drinks Market: Emerging Opportunities”, Indonesia has emerged as one of the fastest-growing food and drinks market in Southeast Asia. This growth is attributed to various factors such as economic growth and increasing urbanisation. Thus, realising the immense growth potential, several domestic and international players have established their facilities to penetrate this flourishing market.

Considering the growth potential, numerous domestic and international players have set up their facilities in a move to penetrate the flourishing market. Major investments have been made in the processed food sector, such as canned goods, snack foods and ready meals. The current value of the Indonesian food industry output is predicted to be around $35 billion.

“The Indonesian food and beverages industry is expected to grow positively despite uncertainties in the global economic environment. The prime reason for this prospective growth is the strong demand for food items and the election campaigns that would assist the industry to maintain its production capacity. Moreover, the industry is hoping that the government would announce stimulus packages to boost exports,” a market research company said.

In 2010, the food and beverage market in Indonesia grew, recovering from the worldwide recession. Purchasing power of middle and upper income consumers revitalised as their disposable income increased coinciding at with an increase in the number of modern retail outlets and food service retailers appearing throughout the country.

According to the research conducted by the World Health Organisation (WHO) the increase in obesity rate in Indonesia from 9.4 per cent to 32.4 per cent in 2010 has caused more concern within the region regarding their health with a significant impact on the food and beverage industry and the demand for ingredients to improve health conditions.

According to studies conducted by Persagi, Indonesian Nutritionists Association, the height of most Indonesian teenagers is 6.7cm lower than it is supposed to be. Therefore, the demand of imported dairy and meat products has been increasing since 2010 (estimated dairy and meat market value of $2 billion in 2010).

Recent studies indicate the youth population of Indonesia (the country has approximately 40.9 million people aged between 15 and 24) shifts towards preference in private label beverage and food products.

On other hand, the future of the packaged food industry in Indonesia also looks promising. The overall packaged food and beverage sector is expected to grow 25.7 per cent from 2009-2013. Positive growth is expected in almost every segment, including dairy, dried processed food and bakery products, which are currently the three largest packaged food segments.

It is also estimated that Indonesian food imports is likely to $10 billion mark in the coming years. Since 2009, the imports have registered phenomenal growth of 25 per cent.

Our export stats

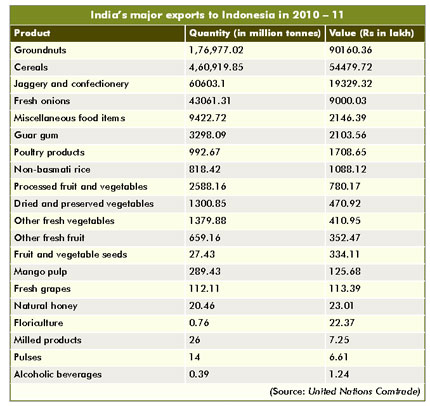

Currently, India’s food exports to Indonesia are dominated by ground nuts, cereals, jaggery, confectionery, fresh onions, guar gum, poultry products, non-basmati rice, processed fruit and vegetables, dried and preserved vegetables, fresh fruit and vegetables, fruit and vegetable seeds, mango pulp, fresh grapes, natural honey, floriculture, milled products, pulses and alcoholic beverages.

“If we observe India’s export statistics to Indonesia, we will realise that a host of niche high value-added products, many produced by small and medium-sized Indian companies finds good markets in Indonesia, and India’s trade sees promising potential for further growth in a range of food product segments,” Al Saba Enterprises, an international food export company, said.

“The country with maximum numbers of Muslims in the world definitely shows ample scope for halal foods. According to Nielsen, Indonesia is a major food consumption market and a major market for halal food, 90 per cent of Indonesian consumers are upbeat about their financial situation for this year, making the country the third most confident country in the world. Indonesia’s per capita GDP is now approximately $3,000 leading to greater confidence about their personal situations,” S S Siddiqui, an industry analyst, told F&B News.

The Ministry for Food Processing Industries in India (MoFPI) aims to promote 14 processed food items comprising of dried and preserved vegetables, mango pulp, other processed fruits and vegetables, pulses, groundnuts, jaggery and confectionery, guar gum (cluster bean), cocoa products, cereal preparations, alcoholic beverages, milled products and miscellaneous preparations.

Further, India’s major export promotion wings expect tremendous scope for Indian processed F&B products in Indonesia. “The major problem with food processing in India is the low productivity in the agricultural sector and fluctuations in output from year to year. Therefore, anyone focussed on exports has to ensure a steady supply of inputs. One method adopted is contract farming, where the producer provides inputs for stable output. Since India has large domestic demand, exports often have to suffer,” Siddiqui added.

Overall the food processing in India only has a future if the policy focus of government is to improve productivity in the agricultural sector, getting remunerative prices for farmers and improving the storage infrastructure across the country.

Retail rise and brand buzz

Indonesia’s retail sales are expected to grow from $133 billion in 2011 to $220 billion by 2015. This is attributed to rising per capita incomes and the continued development of organised retail infrastructure. Food consumption is forecast to increase by 57 per cent from $69 billion in 2011 to $109 billion by 2015.

According to Nielsen, one of the biggest global market research companies, Indonesia is a major food import market. In 2010, Indonesia imported 16.7 million tonnes of food valued at US$9,675 million. Australia’s share was about 25 per cent. Australia is a major exporter of live animals, wheat, meat, dairy and selected fruits, vegetables and gourmet foods to Indonesia.

Further, the health trend seen in many countries all over the world manifests itself differently in the Indonesian market. Many consumers prefer fortified or functional foods over products labelled healthy (or 'better for you'). These functional or fortified products will be received well by the middle to high income classes, and especially by women, who are becoming more concerned with their appearances.

In regards to brand preference, Indonesian consumers prefer internationally well-known brands and imported products, particularly for their children.

“The Indonesian consumer remains in good shape, supported by the demand positives of strong consumer confidence, rising tourist arrival growth and healthy retail sales growth. Looking over the long term, robust macroeconomic fundamentals, an enticing demographic profile and the spread of organised retail underpin a highly dynamic consumer growth story in Indonesia,” S A Kumar from Apeda informed.

Following are the latest news about Indonesia’s retail industry:

The Indonesian retailer expects to deliver 30 per cent growth in total sales to $2.62 billion during 2012

As an ageing population weighs on the growth prospects of the Japanese mass grocery retail (MGR) sector, local convenience store retailer FamilyMart plans to open around 600 outlets in Indonesia and the Philippines

The South Asia’s leading retailers’ plans to have around 300 stores in each of these countries by 2015

South Korean retailer Lotte Department Store plans to launch five new outlets in several cities in Indonesia by 2018

Indonesia is one of the closest eastern neighbours and offers a wide range of opportunities for Indian food suppliers. A large and expanding middle class, increasing awareness of healthy lifestyle issues and a strong growth in the modern retail sector all contribute to Indonesia’s growing demand for imported food products. There are opportunities for Indian food and beverage suppliers of dairy products, selected fresh fruit, processed meats (halal), packaged grocery products, gourmet foods, and organic and health foods.