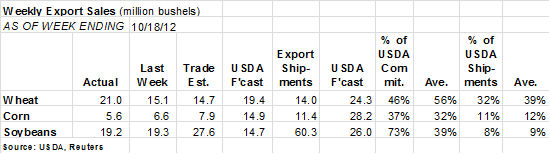

While net new bookings of soybeans were down only 100,000 bushels from the previous week at 19.2 million, the average trade guess was substantially higher. China took 52% of the total but one load of 2.2 million bushels was transferred to Thailand and two more for another 4.2 million were switched to Taiwan. That could be an indication that negative crush margins for the winter are beginning to put the brakes on China's buying spree.

Still, 73% of USDA's forecast for the marketing year has been either sold or shipped, nearly double the usual rate, as business was front-loaded by record preseason sales this summer.

November futures broke after the report, falling back to test the 100-day moving average it moved above on Wednesday's rally. That benchmark comes in at $15.66 today. Selling eased a little after USDA announced the sale of 4.4 million bushels to unknown destinations under its daily reporting system for large purchases, the second big deal reported this week separately.

The weakness in soybeans obscured a good week of wheat sales, which totaled 21 million bushels in the latest week, above both trade guesses and the weekly rate forecast by USDA for the rest of the marketing year. Still, total commitments are slow, and the latest sales were to regular customers, featuring no new deals into North Africa or the Middle East. Prices surged on Wednesday after Ukraine farm minister repeated the country's looming export ban Nov. 15.

Corn also followed soybeans lower, though exports remain lousy at just 5.6 million bushels. The total was even less than the modest expectations of traders, and also came in lower than the previous week. Another disappointing tidbit: China cancelled purchases for 4.7 million bushels. China had been booking U.S. corn over the summer, despite forecasts for record production there.