The hog supply situation is playing out just about as we expected for this summer with numbers well below one year ago and very much in line with our computations, writes Steve Meyer for The National Hog Farmer.

Those figures were based on anecdotal data regarding losses due to porcine epidemic diarrhea virus (PEDV) and actual PEDV case accession data from the National Animal Health Laboratory Network.

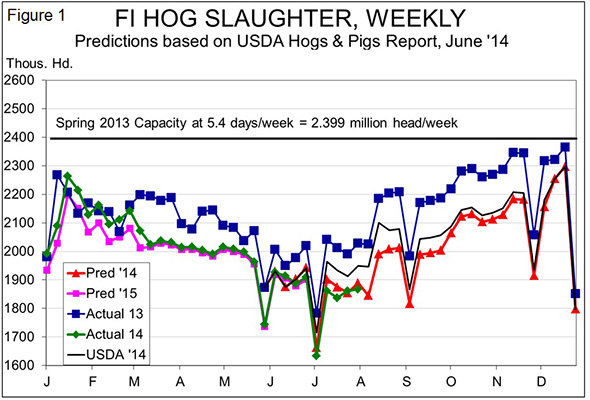

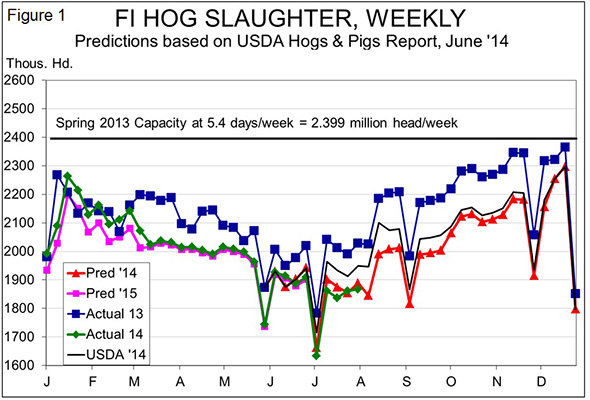

Figure 1 shows weekly slaughter data from last year and this year as well as my forecasts and a forecast based strictly on the US Department of Agriculture’s June Hogs and Pigs report inventories of market hogs.

Those figures were based on anecdotal data regarding losses due to porcine epidemic diarrhea virus (PEDV) and actual PEDV case accession data from the National Animal Health Laboratory Network.

Figure 1 shows weekly slaughter data from last year and this year as well as my forecasts and a forecast based strictly on the US Department of Agriculture’s June Hogs and Pigs report inventories of market hogs.

As can be seen, actual slaughter has been well-below the level of last year and of the USDA-implied slaughter rates.

They have even been lower than my forecast levels for four of the past six weeks, and the two weeks that were larger were just marginally so. Since the week that ended 7 June, FI slaughter has totaled 16.696 million head, 6.3 per cent lower than one year ago and 0.8 per cent smaller than my forecasts.

The total is 2.4 per cent larger than the forecast based on USDA inventories. The past five weeks which covered all of July saw year-on-year reductions that averaged 8.1 per cent ? a number very comparable to my computed July average of minus-7.99 per cent.

My computations for August imply slaughter that is 10.7 per cent smaller than in 2013 and my September number is 12.7 per cent smaller.

I have been reading a few analysts who think the worst of PEDV losses is behind us but I don’t agree.

While there are rumors of packers planning to return to five-day-per-week operation soon, I fear they will still find hogs hard to come by for the next six to eight weeks, especially in the Midwest.

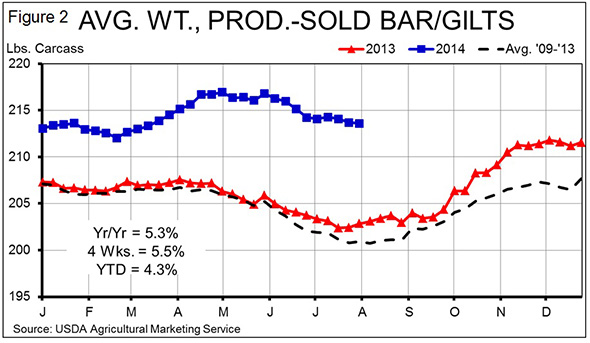

Weights continue to run well above last year (see Figure 2). Though the average weight of producer-sold barrows and gilts declined fractionally in each of the past three weeks, it remains at 213.6, 5.3 per cent larger than one year ago.

That percentage increase is the smallest since the first week of July.

The sum of these supply items means that we have seen some of the largest year-on-year reductions in pork supplies of 2014 in recent weeks.

Last week’s reduction was 3.3 per cent, marking the fourth week in the past five in which this year’s output has been 3 per cent or more lower than one year ago.

Only a weather-driven reduction of 5.3 per cent the second week of 2014 and one week in March had larger year-on-year pork production cuts than the 4.2 per cent and 4.0 per cent of the weeks of July 11 and 18.

So why are cutout values and hog prices lower? The obvious answer is that, at least in the short run, wholesale pork demand has softened a bit. It appears to me that pork buyers overshot the cost levels needed to keep product moving here in the late-summer and bid cut prices up too quickly in July.

The roughly $7/cwt. drop in the cutout value has it priced at a much more reasonable level relative to early May values; ditto for the $6.30 reduction in national producer-sold barrow and gilt prices.

Much as we saw in March, the June and July rally for both pork and hogs were far beyond the magnitude and rate normally seen for seasonal price highs. I expected a downward correction in this market and we’ve seen it.

The question now is “How long will the correction continue?” Here again, I’m seeing some analysts who think the high for the year is in. As readers of this column know, I thought that same thing about the early April peaks.

It is difficult to argue for higher prices in August simply because the normal seasonal pattern is so powerful for hogs but I expect slaughter totals to be so tight in August and September that year-on-year weight increases will get smaller, leaving supplies even shorter relative to last year than they have been in recent weeks.

Chicago Mercantile Exchange Lean Hogs futures traders are certainly expecting a major break in hog prices between now and contract expiration on 14 August, but I’m finding it hard to see a demand circumstance that could be so dramatic as to break cash hogs another $9/cwt. carcass by then.

As I’ve stated above, I don’t see supplies supporting that kind of decline either.

Lower hog prices are coming. That is, as it always is at this time of year, a virtual certainty. But given the accuracy of my hog supply calculations for May, June and July, it appears to me that the recent sell-off in LH futures is overdone and that the recent decline in hog prices will likely slow over the next few weeks.