There are plenty of culprits: trendy new health and energy drinks, the rise of vegan, low-fat and lactose-free diets, and the popularity of alternatives like soy milk. Consumption of those kind of pseudo-milks was up almost 16% last year.

What to do? As the WSJ’s Ian Berry and Kelsey Gee report, milk producers are firing back with new products: low-carb milk, high-protein milks, milk in different sizes and shapes and flavors to meet some of those niches being peeled away to alternatives. But on a deeper level, Big Milk needs to go on the offensive as other industries have done when faced by these kind of disruptions. A few examples:

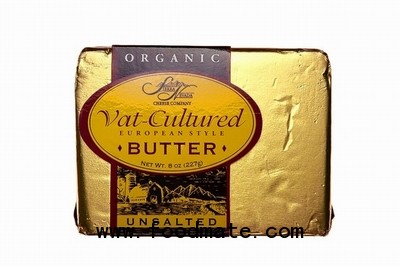

Butter bounces back

Butter was long out of favor with cheaper, supposedly healthier margarine ascendant and new olive oil-based spreads taking their own share of the market. But Butter Is Back. From AdAge, back in June:

Grocery-unit sales of butter grew 2.19% in the year ending May 13, compared with a 0.21% uptick in olive oil and a 6.24% decline in margarine, spreads and butter blends, according to SymphonyIRI data, which excludes Walmart sa WMT +0.15%les. Overall, butter led with $1.5 billion in sales during the period, followed by $1.4 billion for margarine/spreads and $706 million for olive oil.

What’s behind the resurgence? Margarine had the wind knocked out of its sails by its association with transfats, which plenty of health experts ended up concluding were as troublesome — and perhaps more so — than the animal fats found in butter. The butter industry did its part by promoting its product as a natural, honest, old-fashioned stuff made from churned milk, reminding consumers that margarine is an industrial-age invention involving hydrogen gas and finely-ground nickel. And the foodie craze was a helping hand: shoppers became more interested in their produce, particularly in organic products. And just like that, butter was back.

Revenge of the Sugar

Artificial sweeteners, low-calorie diets, an abundance of corn syrup: it wasn’t looking good for sugar. And while the entire market declined in the last decade, sugar has been doing better than its competitors. From the WSJ in 2010:

Per-capita consumption of all caloric sweeteners has dropped about 12% over the past decade as diet-conscious consumers shifted to bottled water or products containing artificial sweeteners. But consumption of corn-derived sweeteners sank at a much faster rate—20%—than did refined sugar, which dropped 3%.

Indeed, according to statistics compiled by the U.S. Agriculture Department, sugar refined from beets and sugar cane is winning back some of the beverage market it lost in the 1980s when Coke and Pepsi embraced high fructose corn syrup for its lower cost. Refined sugar represents at least 6% of the caloric sweetener in U.S. beverages compared to 3.7% in 2005.

Even though doctors and dentists worry about both regular sugar and corn syrup, “the sugar industry has made inroads with some consumers by labeling their corn-derived competition as an artificial sweetener because a lot of processing is involved in making high fructose corn syrup,” the WSJ reported.

The war on high-fructose corn syrup was so effective — plenty of food producers, including Starbucks SBUX -0.78% and Kraft, now publicly advertise that their products don’t contain any of the stuff — that the corn lobby spent years pushing for regulators to allow them to re-brand their product as “corn sugar.” This May, that request was turned down; the sugar and corn industries are also taking the fight to the courts over the term “corn sugar” being used in advertising.

Old-Fashioned Booze Returns

Growth of the bourbon industry remained strong during the last 12 months Brown-Forman Corp. BFB -1.19% CEO Paul C. Varga said Wednesday during an investor conference call.

Responding to a question about the outlook for the industry, Varga said the bourbon industry’s annualized growth rate is about 9 percent, in terms of dollars, during the last 12 months, while the U.S. spirits industry had a run rate of less than 4 percent.

“Bourbon and rye are now hip among young American trend-setters like we’ve never seen before,” Charles K. Cowdery, the author of Bourbon, Straight: The Uncut and Unfiltered Story of American Whiskey told the NYT last December. That’s down to a number of factors: some producers making more high-quality, limited release products for aficionados, others are putting out flavored bourbons for the newbies. The craze for single-malt Scotch whisky also helped, as bourbon producers reminded consumers that many of their products are also single malts.