After a gap of 10 years, the US became the largest importer of Indian seafood items in rupee value terms during the April-September period (H1) of the current financial year (FY13), pushing the European Union (EU) to the second spot. The US’s share in India’s seafood export kitty for H1 stood at 24.40 per cent, followed by the EU at 24.18 per cent, according to the latest data released by the Marine Products Export Development Authority (MPEDA).

After a gap of 10 years, the US became the largest importer of Indian seafood items in rupee value terms during the April-September period (H1) of the current financial year (FY13), pushing the European Union (EU) to the second spot. The US’s share in India’s seafood export kitty for H1 stood at 24.40 per cent, followed by the EU at 24.18 per cent, according to the latest data released by the Marine Products Export Development Authority (MPEDA).However, Indian exports recorded a positive growth in both volume and rupee value terms only to the US. In fact, India suffered a serious setback in marine product exports in all its traditional markets in H1, except the US.

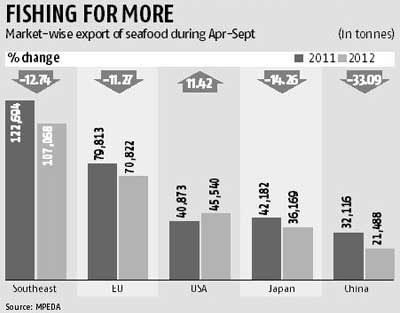

While exports to the US recorded a growth of 11.42 per cent in volume and 9.33 per cent in rupee value terms, shipments to the EU dipped 11.27 per cent in volume, and Japan recorded a dip of 14.26 per cent, according to the MPEDA data. Among the most serious drop was shipments to Japan, where exports dipped in all parameters — volume, rupee and dollar value.

Exports to China also recorded a setback as shipments dropped 33.09 per cent drop in volume terms. Total exports to China during H1 FY13 stood at 21,488 tonnes, valued at Rs 435.41 crore against 32,116 tonnes valued at Rs 486.40 crore during the same period last year.

On the quantity front, south east Asia became the biggest importer with 31 per cent of the total volume of exports, followed by Europe with 20 per cent, the US 13 per cent and Japan with 10 per cent. This is mainly due to the bulk export of low-value items, such as mackerel and Red fin broom to the south east Asian market.

Detection of ethoxyquin, an anti-oxidant used in shrimp feed above the permitted level had stalled shrimp exports to Japan for weeks together in June and July that caused huge loss to exporters in Odisha and West Bengal. The issue is not settled and India has sought intervention of the World Trade Organisation (WTO) in sorting out it.

Global economic recession, especially in the Euro zone, is also a major reason for this set back. Implementation of new import regulations and certification systems in markets such as China and Japan has also hurt exports.