It is also one of the most shareholder-friendly companies around, with an ever-growing dividend and an excellent buyback program in place to create shareholder value. With the company set to report earnings on Feb. 4, investors will be looking for signs that the good times will continue.

Yum! Brands has some of the most recognizable quick-service restaurant names in the world in KFC, Pizza Hut, and Taco Bell. The company sees the most growth opportunity in international markets, particularly in China. In fact, one year ago, Yum acquired a controlling interest in Little Sheep, a casual dining chain in China. During the earnings call, look for updates on how this is going.

Yum! plans to increase the number of restaurants in China at a double-digit annual rate for the foreseeable future, and to grow same-store sales by around 5% annually. To put the Chinese growth potential in perspective, Yum! currently has about 4,500 restaurants in China, with total revenue of $5.6 billion, or about $1.24 million per unit. In the U.S., Yum! has approximately 18,000 restaurants in the U.S, with total revenue of $3.8 billion, or just about $211,000 each.

As the middle class has emerged in China, demand for more convenient dining options has skyrocketed, similar to the growth of fast food in the 1960’s-80’s in the U.S. Just on a population basis, with 1.3 billion people and growing, China has nearly unlimited potential for growth, and the company’s goal of double-digit growth sounds very reasonable indeed.

For those worried about a possible relapse of the recession, Yum! actually does well in hard economic times. When money is tight, people seek lower-cost options for everything they consume, so they tend to eat at Pizza Hut rather than Olive Garden, buy clothes at Target instead of Gap, and groceries at Wal-Mart instead of Whole Foods. In other words, there is always a significant group of people who low-cost options appeal to, both in good times and bad.

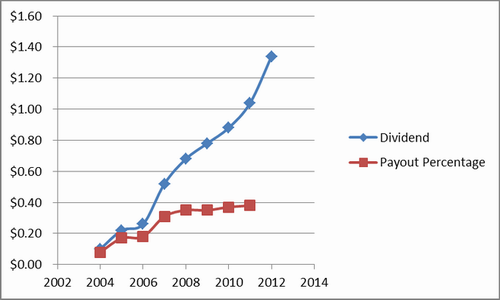

When you consider the dividend yield, it further illustrates the recession-resistant nature of this company. Since the first dividend was issued in 2004, the company has raised the dividend each and every year. The company aims to return 35%-40% of its profits to shareholders through dividends, and have done just that in recent years, including and especially during the recession (see below).

In other words, in order for the dividend to have been raised during the tumultuous economic times of 2008-2010, and the payout percentage to have remained pretty constant, Yum! had to actually make more money during the recession than it had before.

Yum! is attractively valued, especially considering its international growth potential. The stock is currently trading for approximately 20 times 2012’s expected earnings per share of $3.24. Those earnings are projected to grow to $3.60 and $4.16 in 2013 and 2014, respectively. In other words, the consensus calls for a three-year average annual earnings growth rate of 13.2%, which I believe justifies a premium valuation, especially since the growth potential of the international segment has no end in sight.

For comparison’s sake, I’d like to look at the valuation of two other large fast food companies on different ends of the growth spectrum. First, McDonald’s, the most recognizable fast food name in the world, has already capitalized on significantly more of the international potential than Yum! has. Even so, analysts project a 10% annual earnings growth, illustrating that there is still potential to grow, even for a company as large as McDonald's (market cap of $94.1 billion vs. Yum’s $29.4 billion).

McDonald’s trades at a slightly lower P/E of 17.5, which makes sense given the slightly lower earnings growth expected.

On the other end, up-and-comer Chipotle Mexican Grill has vast potential for growth, and is expected to do just that. The consensus calls for Chipotle’s earnings to grow at an average rate of 22.1%, and as a result, the stock trades at a premium valuation of 34.6 times 2012’s earnings.

Compared to these two, Yum seems like a good compromise between growth and an established history of returning value to shareholders. During the earnings call pay particular attention to any comments on the China growth, as well as growth within other international markets. As long as things are going well abroad, it is hard to go wrong with a company like Yum, especially in uncertain economic times.