British beverages giant Diageo plc (DEO, DGE.L) is in talks with Chinese authorities to increase its indirect stake in ShuiJingFang, the Chinese liquor maker behind upmarket baijiu drinks brand, according to the Sunday Telegraph.

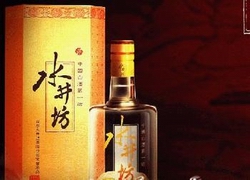

British beverages giant Diageo plc (DEO, DGE.L) is in talks with Chinese authorities to increase its indirect stake in ShuiJingFang, the Chinese liquor maker behind upmarket baijiu drinks brand, according to the Sunday Telegraph.Diageo, the owner of premium drinks brands such as Johnnie Walker and Smirnoff, currently holds a 53 percent stake in Quanxing, the holding company that owns a 39.7 percent stake in ShuiJingFang. Under the current set-up, Diageo owns a 21 percent indirect stake in ShuiJingFang.

The Sunday Telegraph reported that Diageo has approached DOFCOM, the Sichuan provincial department of the Ministry of Commerce, to express its interest in raising its stake in Quanxing. Diageo hopes to further consolidate its position in the premium end of the baijiu market, which is worth 25 billion pounds a year.

Baijiu, a fiery clear spirit usually distilled from sorghum, is a popular drink in China traditionally associated with toasts at dinners and special meals. Its sales make up about half of China's annual spending on alcoholic beverages of 45 billion pounds to 50 billion pounds. The name baijiu literally means "white liquor", "white alcohol" or "white spirits".

Diageo raised its stake in Quanxing to 53 percent from 49 percent in 2011, paying 13 million pounds. Diageo now reportedly hopes to raise its stake in Quanxing to 90 percent, but does not plan to take full ownership. If the deal progresses, Diageo's indirect stake in ShuiJingFang will also increase.

In early November 2012, Diageo and India's spirits producers United Breweries (Holdings) Ltd. and United Spirits Ltd. announced agreements under which Diageo will buy up to 53.4 percent stake for $2.04 billion. The deal would open up an emerging market to Diageo, the largest spirit maker by sales, as United Spirits enjoys more than 40 percent market share in India's spirit sales.

DEO closed Friday's trading on the NYSE at $123.89, up $1.83 or 1.50 percent on a volume of 657,350 shares.