e oil producers are counting on China to increase their earning strength because the nation appears to have developed a taste for the healthy oil.

e oil producers are counting on China to increase their earning strength because the nation appears to have developed a taste for the healthy oil.Because China's climate is not suitable for mass olive production and more Chinese are realizing olive oil is generally healthier than most cooking oils, imports have surged in recent years, especially in top-tier cities such as Shanghai and Shenzhen, where 80 percent of olive oil shipped from Spain, Italy, Australia and Turkey is consumed.

Jean-Louis Barjol, executive director of the Madrid-based International Olive Council, the world's only international intergovernmental organization in the field of olive oil and table olives, said because China's huge middle class is very conscious about food quality and health issues, the Mediterranean diet, which uses plenty of olive oil, is a practical way to maintain health.

"The numerous television advertisements released recently by Chinese olive oil importers and the campaigns led by export countries' trade-promotion bodies to explain the uses of olive oil have resulted in a significant increase in sales, as well as the opening of hypermarkets in the nation's main cities selling imported foods," Barjol said.

"We found people in China are more inclined to buy extra-virgin olive oil, which does not require refining and is 20 percent more costly than refined olive oil," said Amparo Chozaz, assistant managing director of the Spanish Olive Oil Exporters Association in Madrid.

Eager to gain more market share from their already established rivals from Italy and Greece in the China market, Spanish olive oil companies chose to join together in promoting their products under the name Spanish olive oil in the China market.

Chozaz said they spent 4.5 million euros ($6.19 million) on popular cooking programs featuring Spanish olive oil on Chinese TV stations, commercial websites and magazines. They also held national food events to boost their olive oil exports to China in 2013.

With 2.5 million hectares of planting area and 310 million olive trees, Spain contributes more than half of the world's total olive oil production. It shipped 18,700 metric tons of the oil to China in the first three quarters of 2013, up 13 percent from the same period a year earlier, according to the Beijing-based China Chamber of Commerce of Foodstuffs and Native Produce.

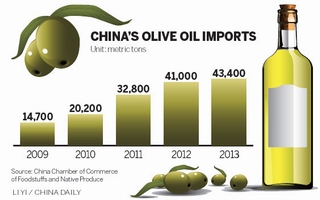

Despite the fact that olive oil accounts for only 1 percent of China's total edible oil consumption, the country's olive oil imports remained strong and hit 43,400 metric tons in 2013, an increase of 5.8 percent from the previous year.

The growing trade figure has also pushed Chinese companies to seek takeover targets overseas that can help meet demand for olive oil back home.

In 2012, six investors from China's textile, garment and agribusiness industries secured a $15.47 million deal for the purchase of the olive oil company Kailis Organic Olive Groves, which owned 3,813 hectares of plantations in Western Australia.

Another major deal was sealed by Jiangxi Qinglong Group, which invested $32 million in Australia to purchase 5,000 hectares of olive plantations last year, as well as half of the shares in Tatiara Olive Processing Pty, a major olive oil processing company in Keith, South Australia.

The Chinese company will invest another $12 million to purchase new equipment and build needed infrastructure to ensure future production. This project is expected to produce 25,716 metric tons of extra virgin olive oil after 15 years and achieve sales revenue of $157 million by then. Both Australia and China will be its main target markets.

"Although Australian olive oil is less renowned than that produced in Italy and Greece, local producers are carrying out strict quality standards to ensure the product's safety," said Shao Yufei, a researcher at the Chinese Academy of Tropical Agricultural Sciences in Beijing.

Shao said a well-developed logistics system, the closer distance to China and appropriate climate conditions are key elements to lure Chinese investment to operate an olive oil business in Australia.

"From a long-term perspective, rising per capita income, an increase in the number of middle-class people and growing demand for more sophisticated food will continue to increase in China," said Zhang Yuxin, a professor at the Chinese Agricultural University in Beijing.

"The biggest attraction of investing abroad is that domestic demand is strong for a number of agricultural products. Products such as olive and palm oil, soybean, beef and certain fruits to a certain extent have become more dependent on foreign markets," Zhang said.