Additional tariffs of 15 percent would be applied to exports of fruits, dried fruits and nuts (among other products) from the U.S. in retaliation for tariffs introduced by the United States. Chinese customs began levying these additional tariffs April 2, 2018.

Value of U.S. Fresh Fruit Exports to China

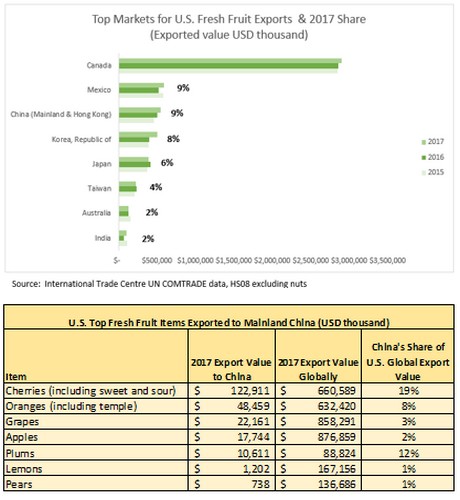

U.S. exports of fresh fruit to Mainland China and Hong Kong were valued at USD $544.5 million in 2017 (Source: UN COMTRADE). China is a sizeable market for U.S. fresh fruit exports.

Potential Impact on U.S. Fresh Fruit Exports

It is difficult to forecast the impact of increased tariffs on U.S. imported fruit into China. Fresh fruit is typically traded through private contracts, unlike grain, soybeans and other commodities, which trade on an open futures market and provide transparent price data. Additionally, there are other factors at play which could affect demand:

1.Competitiveness of the U.S. dollar

2.Price sensitivity of Chinese consumers for different fruit categories

3.Chinese fruit production and quality

4.Quality of U.S. fruit imports

5.Supply from competing markets and price differences

6.Chinese consumers' choice to boycott U.S. items

Competitiveness of U.S. Dollar

China’s currency, the renminbi (RMB), rose by almost 7 percent against the U.S. dollar in 2017, and analysts are predicting the renminbi to continue appreciating through 2018. A strong Chinese currency will reduce the price of U.S. imports.

Price sensitivity of Chinese consumers

Price is not the biggest consideration for Chinese consumers when buying fruit, especially not across all fruit categories. Good taste is the top reason Chinese consumers purchase imported food, according to a consumer study on China's Imported Food Products commissioned by the USDA’s Agricultural Trade Office in Shanghai. Many Chinese consumers purchase imported food impulsively, but for those planning the purchase, the product’s country of origin is one of the top considerations for purchase.

Prior to additional tariffs, U.S. imported fruit prices averaged higher than Chinese produced fruit and other imports. Wholesale market price reports show U.S.-imported oranges currently priced more than double other imported varieties and higher than the domestic variety, and still U.S. fresh orange imports to China have increased consecutively in the last three years through 2017 (ITC/UN Comtrade).

Outlook for key U.S. fresh fruit categories exported to China

Cherries

Sweet cherries are the highest-value U.S. fresh fruit export to China. More than half of the $226 million in U.S. fresh fruit exports to mainland China last year came from cherries, having grown more than four-fold since 2013 (Source: Fresh Fruit Portal).

Any lessened demand for U.S. cherries may depend on quality. According to the USDA’s 2017 China Annual Stone Fruit Report, “Chinese consumers love cherries and consumption is increasing quickly in the wake of greater supplies as domestic production and foreign imports both increase. Chinese consumers like large fruit size (10 row or above), dark red, sweet taste, firm and crunchy cherries, according to an industry survey. Therefore, imported cherries that meet these characters become more and more popular among Chinese consumers, especially among the high-income urban middle-class.” While competition in the Chinese cherry category has become tougher, as more big companies have decided to import the fruit, the category is not as price elastic. Higher priced U.S. cherries may not affect demand if the quality is good.

During the summer months, U.S. cherry imports will likely compete with Canadian cherries, which are higher priced than U.S. cherries, but also higher quality. With higher U.S. cherry prices, this could close the price gap and make Canadian cherries more competitive. U.S. cherry imports will not compete as much with Chilean cherries, which hold the largest market share of imported cherries, as Chilean shipments peak December-February. Turkey is the world’s largest producer and started shipping to China in July 2017. However, with older varieties and lower quality, Turkish cherries may not prove significant competition for the U.S.

The U.S. has other markets for cherries. Canada is the largest market for U.S. fresh sweet cherry exports, followed by South Korea.

Citrus

Chinese orange consumption in 2018 is expected to rise as a result of the larger Chinese crop and continued robust Chinese consumer demand for high-quality fresh fruit, according to the USDA. Chinese production has increased and taste is good, though the 2018 Chinese orange crop is smaller-sized. Despite increased Chinese production, Chinese orange imports are expected to grow due to robust consumer demand for high-quality and counter-seasonal fruit. And import prices may be more comparable to domestic production, as China’s input costs have contributed to increased wholesale prices. There appears to be greater market acceptance of the higher prices (Source: USDA China Citrus Annual Report).

With increased prices, U.S. orange exports may be affected by some competition from South Africa and Australia. Australia has a different season than U.S. citrus, but some months may overlap. Australia produces counter-seasonal to Chinese citrus production, and they have an advantage with closer proximity to China than other citrus producers, with shipping from Brisbane at 13 days. Australia also has a free trade agreement in place with China. Australian citrus exports to China faced a tariff of 11 percent. Under ChAFTA, the tariff has been reduced to 6.1 percent, with a further reduction to come on January 1, 2019. Egyptian citrus may compete with the U.S.

Apples

Apples are the most popular fruit consumed in China, but are losing popularity because of limited varieties and the increased availability of other fruits. China is less reliant on import volume in this category as domestic production has increased consistently over the last 10 years. However, China’s share of high quality production is low and Chinese consumers demand the higher quality imported apples offer.

In its annual deciduous fruit report for China, USDA projects China’s apple imports to increase 14 percent in the 2017/2018 season. A low supply of domestic high-quality apples, exacerbated by a severe drought, contributes to the demand for higher quality imported apples. The Unites States, New Zealand and Chile remain top suppliers. With increased tariffs, the U.S. may experience more competition from New Zealand, although U.S. pricing was more competitive prior to tariffs. In 2017, China imported 29 thousand tons at 1,539 USD per ton from the U.S. and 22 thousand tons at 2,135 USD per ton from New Zealand.

Mainland China & Hong Kong accounted for 6 percent of the value of U.S. global apple exports in 2017.

Source: PMA.com