Hindustan Unilever and Nestle plan to launch oats under Knorr and Maggi brands, respectively, as healthy extensions of their noodle segment this year, two people familiar with the development said. While Nestle didn't comment to an email query, a HUL spokesperson declined to comment on "market speculation".

Oats—a grain that is still considered horse feed in some parts of the world including pockets in India—has already emerged a popular breakfast cereal on the back of increasing demand for health food in metros and big cities.

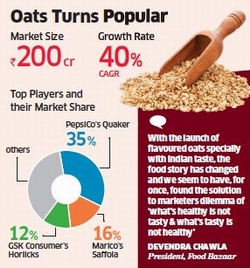

While PepsiCo's Quaker Oats, which calls itself the World's No. 1 Oats brand, entered India over seven years ago, more than half a dozen food companies including GSK Consumer, Kellogg India, Britannia and Marico have entered the Rs 200-crore oats market, which is growing more than 40% annually, over the last few years. Despite a healthy growth rate, the Rs 600-crore breakfast cereal industry has not made much progress in trying to convince Indians to change their eating habit from oily parathas to healthy options.

That's because when they have had to make a choice, Indians have always preferred health to taste. For example, Nestle's Maggi noodles alone is estimated to be more than Rs 1,100-crore brand, almost double the size of overall breakfast cereal market. Now, some experts say marketers have found a way to bring taste and health together with flavoured oats.

That's because when they have had to make a choice, Indians have always preferred health to taste. For example, Nestle's Maggi noodles alone is estimated to be more than Rs 1,100-crore brand, almost double the size of overall breakfast cereal market. Now, some experts say marketers have found a way to bring taste and health together with flavoured oats."A lot of experimentation has taken place in last 2-3 years in breakfast category and with the recent launch of flavoured oats specially with Indian taste the entire story has changed and we seem to have, for once, found the solution to marketers dilemma of 'what's healthy is not tasty and what's tasty is not healthy'," Devendra Chawla, president—Food Bazaar at Future Group, says. Hence, companies are shifting their communication to oats being amenable rather than just healthy to Indianise their offerings.

"While there challenges in changing Indian consumers' food habit, breakfast as an occasion is seeing the maximum change," says Sameer Satpathy, marketing head of Marico, which was the first company to launch masala oat variant. "The organized breakfast market is under penetrated and new entrants will help grow the segment even as competition intensifies," he added.

PepsiCo's Quaker is by far the market leader with share of over 35% ahead of Marico's Saffola and GSK Consumer's Horlicks. Traditionally, companies were focused on South India, which accounts for more than three-fourth of the total market but recently began expanding nationally.

Quaker, which has been selling the masala variant since last year, has extended the brand to Indian ready-tocook mixes such as upma and poha this week. Industry officials said that Kellogg and GSK Consumer too plan to launch masala oats soon.

Future Group's Chawla says oats has the potential to grow beyond just a morning snack. "While consumer interest is high, the challenge is to take it beyond breakfast including snacking and meals like noodles and even include kids, which currently is not the case," he says.

The decision of HUL and Nestle to enter the segment is also triggered by their slowing growth. For instance, while HUL's processed food and beverages portfolio has grown at 16.4% CAGR over CY05-FY10, its growth rate has decelerated to 13.2% in the last two years, despite the company being aggressive with its Knorr portfolio.

Similarly, Nestle is expected to post its lowest revenue growth of 11.3% in 7 years in 2012. Anand Mour of ICICI Securities, in a report, wrote that Nestle's low revenue growth is "driven by channel rationalisation, deceleration in growth of food business and competition in noodles segment".