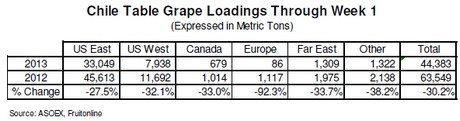

Loadings to the USEC and USWC were down 27.5% and almost 32%, respectively. Loadings to Canada and Chile’s Far Eastern markets were each down by around 33% and loadings to Europe were down by over 93% with just 86 metric tons shipped this year through Week 1.

Grape departures from Chile are expected to remain lighter than last season for the next two weeks as grape production in the IV Region has been seriously shortened due to drought and due to generally smaller caliber fruit in both IV Region and V Region causing reduced tonnage per hectare. With the crop in the Aconcagua region said to be running up to ten days later than initially expected, expect to see gaps in the supply of Flames in the last week of January and first week of February.

Diminished production and resulting lighter loadings have had what can only be called “normal consequences”: The spot market price for grapes is very high. Those who made pre-commitments are back-peddling, crying, or both. Program commitments from Chile are often not being honored by growers who see momentary opportunity.

Retailers are looking for alternative products to promote. And anyone who engages in even the mildest form of forward thinking must be wondering what effect this will

all have on the market come mid-February.

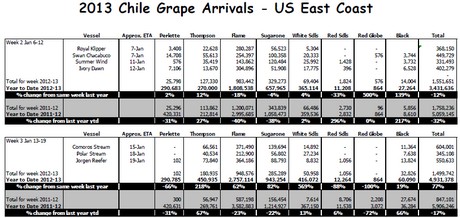

In Week 2, 1 million cases of Flames are expected to arrive on the East Coast, but most of this will not get into distribution until Week 3. With a very light carryover

of Flames into Week 2, Flames are being absorbed by the market as quickly as they arrive. Flame prices have been solidly at US$ 34 – 36 with some sales at US$ 38 and even US$ 40. Of course, there are pre-commitments at US$ 30 – 34, which may have seemed like a good idea at the time, but not so much now.

White seedless prices in Week 2 lagged behind Flames in spite of an expected combined arrival volume of fewer than 520 000 cases. White Seedless prices have

remained stable at US$ 30 – 34 on all varieties, size and variety depending.

Red Globes continue to hover at US$ 22 – 24 (mostly US$ 22), a price that seems to be peculiarly (and counter-intuitively) immune to the shortage of seedless red

grapes.

Predicting the market in a season such as this is a tricky business. It is clear that grape volumes will increase as San Felipe and Los Andes come into production although, as we have said earlier, that harvest is delayed. Grape prices should hold firm through Weeks 3 and 4 with a natural downward tendency as the pipeline slowly gets filled in a market where relatively few chain stores promoting grapes. It would not be a surprise at all to see Flame prices remain in the US$ 30+ range

through Week 4 and only soften when the Aconcagua fruit hits the market. Expect to see white seedless prices soften a little more quickly, but remain stable through Week 4.

What happens after Week 4 will be entirely determined by the pace of arrivals and the ability of sellers to get their grape-starved customers interested in promotions.

For now, chains are struggling to meet their basic grape needs. Sellers are being cautious about making promotional offers or forward price commitments until they

see a ramping up of production. Hopefully, the increase in arrivals (and there will be one) will come with sufficient warning to allow the market to adjust in an orderly

fashion.

Medfly Detected:

Late in Week 1, it was reported that there was a Mediterranean Fruit Fly detected near Valparaiso. While it is generally believed that the pest was a hitchhiker on an

inbound vessel, it has created some complications. A protocol has been implemented to allow vessel loading to continue at Valparaiso provided product is packed in microperforated bags or arrives from the packing facility on pallets with prescribed mesh netting.

Port Strike Revisited

Last week it was reported that the east coast ports strike threat had been averted with an agreement in principle reached by the two sides on the most controversial issue between them. Both parties were optimistic that the remaining terms could be worked out before the new deadline of January 28.

It has been reported that negotiations have once again broken down under the weight of another controversial issue between the parties - an issue peculiar to the

ports of New York and New Jersey. Negotiations are expected to resume again and there remains plenty of time for the sides to work out their differences. But the

persistent threat of strike continues to be a source of concern and annoyance.