In fact, as Packaged Facts noted in a report earlier in 2012, cereal and granola bars have met with competition from not only nutrition and energy bars, but also with an array of other snacks perceived as healthier—including cheese, yogurt and trail mixes.

“Since 2007, the cereal bar segment has become more narrowly focused on health and weight management,” the firm wrote. “Granola bars, however, are benefitting from renewed interest, reflecting in part a consumer enthusiasm for ‘real foods’ with simpler, recognizable and wholesome ingredients. Products introduced in the past few years have emphasized functional health benefits, all-natural and organic ingredients, taste, flavor and form variety. An especially popular attribute is added fiber.”

Recent fiber-enriched cereal bar introductions have marketed themselves as more than simply fiber-rich, however. Rickland Orchards in Canada has introduced a range that meets one of the food industry’s major recent trends head-on: Greek yogurt. The company’s Greek Yogurt Granola Bars feature 5g of fiber per 40g bar, as well as probiotics (indeed, claiming 1 billion live active cultures per bar). The bars are offered in two flavors, each of which also attempts to capitalize on a trendy phenomenon: Blueberry Acai (superfruits) and Cranberry Almond (antioxidants). While a bar features 20% of the daily recommended value of fiber, each also contains at least 10% of the recommended allotment of fat: 6g (10%) in the cranberry almond variety; 7g (11%) in the blueberry açai form.

Superfruit and antioxidant benefits are also central to a range of launches from Kellogg under its Nutri-Grain brand. In fact, in a recent relaunch of the line, the cereal manufacturer put more emphasis on the fruit and antioxidant content than the actual Nutri-Grain brand. Its Superfruit Fusion Cherry Pomegranate Cereal Bars promise to be rich in vitamins C and E, and calcium, providing 20% of the RDA of each. While its 3g fiber content is not foremost on the labeling, that does equate to 12% of the RDA, and the 3g of fat is 5% of the daily recommendation.

Wining

Resveratrol’s antioxidant benefits have been widely touted in wines, but one recent bar introduction brought that consumer recognition into a new segment.

ResVez Inc. introduced its WineTime Chocolate, Date & Almond Bar by noting it contains more resveratrol than 50 glasses of red wine. However, the bar also capitalizes on a number of other trends, including allergen-free (free of gluten and dairy) and superfruits (containing the superfruits açai, blueberry, goji, manosteen, noni and pomegranate).

Antioxidant enrichment is the primary selling point of Nut-rition Antioxidant Bars under the Planters label. The bars promise antioxidant vitamins C and E through a mix of almonds, blueberries, cranberries and peanuts. Apure Foods takes antioxidants a step further by adding cocoa to walnuts and cranberries in its Cranberry Walnut Granola Clusters, while NuGo Nutrition’s Peanut Butter Chocolate Bar promises natural flavanol antioxidants, delivering 40% of the RDA of vitamins A, C and E, plus 20% of the daily calcium needs, in each 50g bar.

The latter’s NuGo Dark protein bars—already non-dairy, vegan, kosher pareve and low in fat—have now been certified gluten-free. All five flavors of the bars (including Dark Chocolate Chocolate Chip and Mocha Chocolate, the two most-recently certified gluten-free) contain 10g of protein and promise all-natural ingredients. Likewise all natural, the Complete Bar from Anti-Aging Essentials promises 40 antioxidants, 5g of dietary fiber, 15g of protein, three digestive enzymes and natural probiotics. Health Warrior similarly has a variety of antioxidants, including caffeic acid, chlorogenic acid, myricetin, quercetin and kaempferol, in its Chia Bar with Chocolate & Peanut Butter. These bars also boast 1,000mg of omega-3 and 4g of dietary fiber, plus chia, known to sustain energy and satisfy hunger.

Pros of Proteins

As the Complete Bar would suggest, protein is another of the many features bar manufacturers are using to differentiate their introductions. Big Bully USA boasts 20g of protein in its Fitness Performance Nitric Oxide Bar, which also features 3g of sugar and 5g of arginine. Arginine is an amino acid the body converts into nitric oxide, a vasodilator that eases the pumping of blood throughout the body and which may help reduce body fat while increasing lean muscle mass. With slightly less protein (11g) and one third the sugar of the Big Bully bar, Atkins Nutritionals’ Day Break Peanut Butter Fudge Crisp Snack Bars contain 150 calories per 35g bar.

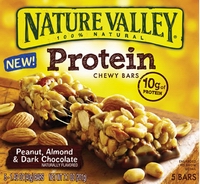

At one time firmly in the domain of products for the seriously body-conscious consumer, protein has emerged as a point of differentiation for cereal bars, blurring the line somewhat between energy/nutrition bars and their cereal/granola siblings. General Mills, for instance, has 10g of protein per bar in its peanut butter and dark chocolate Chewy Bars, as does Kellogg’s Protein Meal Bar, which also boasts 5g of fiber. The latter company has also introduced a Special K Cranberry Walnut Protein Meal Bar, whose 10g of protein and 5g of fiber are intended to help consumers manage their weight.

With slightly less protein (9g), South Beach Diet’s Cinnamon Raisin Flavored Protein Fit Cereal Bars promise to be a good source of vitamin A, calcium, fiber, iron and zinc, while they also contribute folate, niacin, riboflavin, thiamin, and vitamins B6 and B12. Life Choice Foods’ Meal Bars are another in the long line of bars boasting 10g of protein and promising to help control appetite; the Wal-Mart exclusive line is available in Chocolate Crunch, White Chocolate Pretzel and Peanut Butter Crunch. The company also has a Peanut Butter Extreme High Protein Bar with 21g of protein “to help rebuild muscle,” as well as 18 vitamins and minerals.

Protein content for most cereal bars, however, hovers in the 10g range, with 5g of fiber, as well; such is the case for the Nature Valley brand of protein bars from General Mills. The two flavors (Almond & Dark Chocolate and Peanut Butter Dark Chocolate & Peanut) appear to capitalize on consumer desire for a healthier snack over mindless consumption.

General Mills’ U.S. snacks division president Jon Nudi, commenting during a September 2012 conference call with industry analysts, noted the line is on track to equal the performance of Fiber One 90-calorie brownies, which registered more than $100 million in retail sales in their first year.

As Nudi put it, “Nature Valley protein bars contributed double-digit retail sales growth for the brand in fiscal 2012 and are on track to be as big as Fiber One Brownies in year-one retail sales.” He continued, “U.S. consumers are snacking more than ever. Instead of mindless munching, consumers are increasingly looking for options that provide real nutritional benefits, so it’s no wonder that better-for-you snacks are the fastest growing segment in the category.”

Overall, the food bar segment accounted for $5.7 billion in the U.S. alone in 2011, with the nutrition/energy bar portion accounting for $2.5 billion, according to Packaged Facts. That segment enjoyed a 16% growth from 2010 to 2011, and Packaged Facts predicts sales of nutrition/energy bars will hit $4.5 billion by 2016.

Cereal and granola bars are an even larger segment, at least at present; Packaged Facts notes U.S. retail sales hit $3.15 billion in 2011. However, the fortunes of cereal bars vs. granola bars have differed. Sales of cereal bars fell 1.8% from 2010 to $1.18 billion in 2011. Meanwhile, granola bar sales increased 3.6% to $1.96 billion and accounted for 62% of the category in 2011.

Going forward, Packaged Facts expects the cereal/granola bar and energy/nutrition bar category combined will hit $8.3 billion in sales in 2016, indicating cereal/granola bar sales that year will be in the range of $3.8 billion, ahead of the 2011 performance, but exhibiting nowhere near the same growth as the nutrition/energy bar segment. However, as the lines blur between bars’ segments and consumers continue to look to snacks as an affordable, convenient and nutritious option, the category overall should enjoy significant sales growth in the coming years.