UK begins season with empty market

The prospects for the upcoming British Conference season are looking good. For the Concorde, a 10% decrease is expected due to the weather. "But it's still early days, so the weather can still influence the harvest," one British trader says. The market is expected to be empty when the British season starts. The volumes in Great Britain have been limited by 25,000 tonnes, corresponding to 15% of British demand.

Belgium and Netherlands focus on Germany

Due to the Russian boycott, pear traders had to look for new markets. While for apples a number of countries could be enticed, that was more difficult for the Conference, the most grown pear in Belgium and the Netherlands. The rough skin dissuades consumers. German consumers aren't scared away, quite a bit was exported to the Central European country.

In the Netherlands, the season is expected to begin later, but in general the mood for the new season is optimistic. "It might not be a top harvest, but it will be a good harvest," a Dutch trader says. The rain showers that fell in the Low Countries in the past weeks, were received with open arms: "The rain that fell was worth its weight in gold for the new produce!" Business isn't going that smoothly toward the end of the season, with competition from the summer fruit. Export destinations are, apart from Germany, England, France and Spain, although the new harvest is starting there. Eastern Europe as well, and Poland in particular, remains a big market for the pears.

Germany: high consumption, high import

The German consumer eats an average of 2.4 kilos of pears a year, corresponding to a total volume of 201,000 tonnes. Despite these numbers, Germany is traditionally not a production country for pears, and most of the market is filled with import.

Dutch and Belgian trade have started to target neighbouring Germany. The countries are working together on a promotional campaign for the Conference pear. For the upcoming season, the countries are hoping to increase the export. The Conference from the Benelux competes on this market with the smaller volumes of German harvest and the Italian Abate Fetel.

But there is competition from overseas as well: Abate Fetel, Packham's Triumph and Forelle from countries like Chile, South Africa and Argentina can be found on the German market. The prices on the wholesale markets have been stable in recent weeks.

French pear market empty at start season

The French market is empty when the new season starts. According to one French trader, no pears from overseas are available. In the south-east of France, the Gruyot pear harvest has begun, and in the middle of next week this pear will reach its seasonal peak. In general, the estimates are good. Volume-wise it's an average season, with lower volumes than last year. For the Gruyot, larger volumes are expected, in the estimates Williams is expected to have lower volumes. The harvest for this variety starts early in August. The French export mostly focuses on the Dutch and Belgian markets.

The German consumer eats an average of 2.4 kilos of pears a year, corresponding to a total volume of 201,000 tonnes. Despite these numbers, Germany is traditionally not a production country for pears, and most of the market is filled with import.

Dutch and Belgian trade have started to target neighbouring Germany. The countries are working together on a promotional campaign for the Conference pear. For the upcoming season, the countries are hoping to increase the export. The Conference from the Benelux competes on this market with the smaller volumes of German harvest and the Italian Abate Fetel.

But there is competition from overseas as well: Abate Fetel, Packham's Triumph and Forelle from countries like Chile, South Africa and Argentina can be found on the German market. The prices on the wholesale markets have been stable in recent weeks.

French pear market empty at start season

The French market is empty when the new season starts. According to one French trader, no pears from overseas are available. In the south-east of France, the Gruyot pear harvest has begun, and in the middle of next week this pear will reach its seasonal peak. In general, the estimates are good. Volume-wise it's an average season, with lower volumes than last year. For the Gruyot, larger volumes are expected, in the estimates Williams is expected to have lower volumes. The harvest for this variety starts early in August. The French export mostly focuses on the Dutch and Belgian markets.

Positive expectations Italian pear season

Italy is a major grower of pears. On the world ranking, the country is in fourth place, with only China, the US and Argentina ahead of it. Of the European production, 45% comes from the Southern European country. The provinces of Ravenna, Ferrara, Bologna and Modena are home to most of the pear growers, accounting for nearly 80% of production. Adding the provinces of Rovigo and Manuta, these provinces have 90% of the Abate cultivation. The expectations for the season are positive. Ravenna is expecting a very good harvest of the early varieties, Modena has more moderate estimates. The rain in May was good for the pear growers, although the persistent heat could cause problems for the small and middle sizes. The later varieties, William, red William, Conference, Decana, Kaiser and Abate, are facing the same problems.

The harvest of the summer pears started in week 27 around Naples, with the Coscia pear harvest. High temperatures accelerated the fruit's growth, but the market responded tamely to the pear. Prices were lower than last year. In week 28, more volume of new harvest entered the market, putting prices under pressure. This week, supplies of Morettini, Santa Maria and Carmen got started in Emilia-Romagna.

Spain expects lower volumes

The first harvest of Limonera and Ercolini pears started two weeks ago in Murcia, Aragon and Catalonia. The volumes in Murcia are high, in other regions the season is just getting started. Volumes for Ercolini are estimated to be higher than last year. The Limonera, not suitable for storage, are seeing high demand on the Iberian peninsula, the Middle East and Germany. In Rincón de Soto, La Rioja, the harvest is also expected to be smaller than in previous years. The acreage comprises 850 hectares, with a production estimate between 15 and 20 million kilos, while 17 million kilos were harvested last year. The harvest starts toward the end of August.

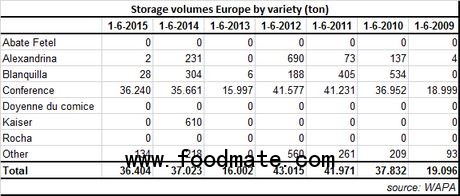

In Catalonia, about 2400 tonnes of Conference pears are in storage, 25% less than the average over 2011-2014, but 3% more than last year.

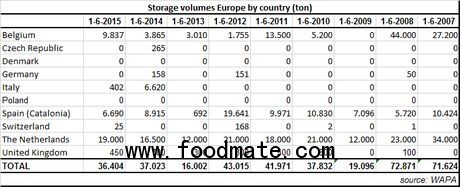

Portugal: fewer Rochas

The pear storage in Portugal is empty. Halfway through next month, the Rocha pear harvest begins. According to estimates, the harvest will be 30% lower this year. Last year, the season was good in terms of volumes, but bad in terms of prices. Like the Northern European countries, the Portuguese are targeting Germany, with more being exported to this market last year. Besides Germany, Brazil is the most important market in terms of volume, but the British market yields the best prices.

South Africa: unfounded fear Russian economy

Of the two most important varieties, the Packham and Forelle, good volumes were available, although availability decreased from week 20 onwards. That lasted until the end of the season. At the beginning of the season, South African exporters were uncertain about sales to Russia and the economic situation there. Russia is one of the main markets for the African country. The exporters were also worried about smuggling from Europe, which could hinder South African sales. The worries turned out to be unfounded, however, prices in Russia were good, and in hindsight the pear season was better than previous seasons regarding sales to Russia.

China: more import

The Chinese market shows potential for the Conference pear. Last year, the Netherlands got permission to ship the pear to China, after 5 years of negotiations. The first pears have been exported, but volume-wise China is still in its Conference infancy. One trader says the Conference is "not the best choice" for the Chinese consumer, who prefers domestic produce. In June, Australia and China signed an agreement that also applies to the trade in pears, although Australia hasn't yet started this export. The agreement also provides for a reduction of the import tariffs in the next four years, with import tariffs currently being between 10 and 30%.

According to local traders, the Chinese harvest is better than previous years this season. In the province of Hebei, North-east China, Easy Crisp, Green Jewel and Golden Pears are grown. For the first variety, the season is ending, the Golden Pears season is about to begin. In Shangdong, North-east China, the Housui pear season is starting. Volumes are exported, but estimates predict the export volume to be lower.

Reports say there's still 15% in storage. One Chinese trader says the main export markets are Europe, the Middle East, America and Russia. Chinese traders are worried about the economic developments. The consumption is under pressure due to decreasing purchasing power.

One trader in Hong Kong says that in China, a large harvest is expected, 20% more than last year. Due to the absence of enough rain, the sizes will be smaller though. The Chinese pear cultivation is said to be under pressure. Growers emptied the orchards and switched to apples, a market that has problems of its own. Exporters consider pears a product that's too delicate, instead focusing on the domestic market.

US: Red Bartlett losing popularity

In the northwest of the United States, the season starts a few days earlier. Because of the warm spring, the season has been brought forward. In the estimates, the volumes are 2% higher than the five-year average, but 2% lower than last year's harvest. The Bartlett and Starkrimson harvest starts in August, with larger volumes halfway through that month. In September, the harvest of winter varieties d'Anjou, Bartlett and Bosc follows. In the state of Washington, the harvest is estimated to be 20.4 million standard industry boxes. The Red Bartlett is losing popularity among growers and consumers, while the Starkrimson is on the rise.

Australian growers pleased with open market Vietnam

The reopening of the Vietnamese markets was good news for the pear exporters in Australia. Over the past years, the export to Vietnam increased year over year, with 64 tonnes in 2012, 82 tonnes in 2013, and 106 tonnes in the first nine months of 2014. In September of last year, Vietnam closed its borders to Australian pears. Vietnam is an important market for some exporters. Shanghai, Hong Kong and Thailand are other important markets, as are Indonesia, Canada and New Zealand. All in all, the export amounted to 3,317 tonnes, or 5.5 million dollars, in May 2015. For most growers, the harvest season ended in May, with the Packham and William being the most important varieties. Australian organization APAL is, in cooperation with a number of other parties, doing research into the health aspects of pears.

Israel only grows for own market

The pear harvest in Israel started a week or two ago. The top fruit stays within Israeli borders, with some traders importing pears to meet domestic demand. According to one Israeli trader, the consumer prefers the Nashi pear over the Conference. "The Nashi pear is a difficult product. It's a club variety with a high brix, crunchy and juicy."

Every week, FreshPlaza publishes an overview of the market situation of a product in a worldwide context. With these articles, we're aiming to give an idea of a global market that's becoming ever smaller as a result of globalization. Next week, the spotlight is on grapes.

Italy is a major grower of pears. On the world ranking, the country is in fourth place, with only China, the US and Argentina ahead of it. Of the European production, 45% comes from the Southern European country. The provinces of Ravenna, Ferrara, Bologna and Modena are home to most of the pear growers, accounting for nearly 80% of production. Adding the provinces of Rovigo and Manuta, these provinces have 90% of the Abate cultivation. The expectations for the season are positive. Ravenna is expecting a very good harvest of the early varieties, Modena has more moderate estimates. The rain in May was good for the pear growers, although the persistent heat could cause problems for the small and middle sizes. The later varieties, William, red William, Conference, Decana, Kaiser and Abate, are facing the same problems.

The harvest of the summer pears started in week 27 around Naples, with the Coscia pear harvest. High temperatures accelerated the fruit's growth, but the market responded tamely to the pear. Prices were lower than last year. In week 28, more volume of new harvest entered the market, putting prices under pressure. This week, supplies of Morettini, Santa Maria and Carmen got started in Emilia-Romagna.

Spain expects lower volumes

The first harvest of Limonera and Ercolini pears started two weeks ago in Murcia, Aragon and Catalonia. The volumes in Murcia are high, in other regions the season is just getting started. Volumes for Ercolini are estimated to be higher than last year. The Limonera, not suitable for storage, are seeing high demand on the Iberian peninsula, the Middle East and Germany. In Rincón de Soto, La Rioja, the harvest is also expected to be smaller than in previous years. The acreage comprises 850 hectares, with a production estimate between 15 and 20 million kilos, while 17 million kilos were harvested last year. The harvest starts toward the end of August.

In Catalonia, about 2400 tonnes of Conference pears are in storage, 25% less than the average over 2011-2014, but 3% more than last year.

Portugal: fewer Rochas

The pear storage in Portugal is empty. Halfway through next month, the Rocha pear harvest begins. According to estimates, the harvest will be 30% lower this year. Last year, the season was good in terms of volumes, but bad in terms of prices. Like the Northern European countries, the Portuguese are targeting Germany, with more being exported to this market last year. Besides Germany, Brazil is the most important market in terms of volume, but the British market yields the best prices.

South Africa: unfounded fear Russian economy

Of the two most important varieties, the Packham and Forelle, good volumes were available, although availability decreased from week 20 onwards. That lasted until the end of the season. At the beginning of the season, South African exporters were uncertain about sales to Russia and the economic situation there. Russia is one of the main markets for the African country. The exporters were also worried about smuggling from Europe, which could hinder South African sales. The worries turned out to be unfounded, however, prices in Russia were good, and in hindsight the pear season was better than previous seasons regarding sales to Russia.

China: more import

The Chinese market shows potential for the Conference pear. Last year, the Netherlands got permission to ship the pear to China, after 5 years of negotiations. The first pears have been exported, but volume-wise China is still in its Conference infancy. One trader says the Conference is "not the best choice" for the Chinese consumer, who prefers domestic produce. In June, Australia and China signed an agreement that also applies to the trade in pears, although Australia hasn't yet started this export. The agreement also provides for a reduction of the import tariffs in the next four years, with import tariffs currently being between 10 and 30%.

According to local traders, the Chinese harvest is better than previous years this season. In the province of Hebei, North-east China, Easy Crisp, Green Jewel and Golden Pears are grown. For the first variety, the season is ending, the Golden Pears season is about to begin. In Shangdong, North-east China, the Housui pear season is starting. Volumes are exported, but estimates predict the export volume to be lower.

Reports say there's still 15% in storage. One Chinese trader says the main export markets are Europe, the Middle East, America and Russia. Chinese traders are worried about the economic developments. The consumption is under pressure due to decreasing purchasing power.

One trader in Hong Kong says that in China, a large harvest is expected, 20% more than last year. Due to the absence of enough rain, the sizes will be smaller though. The Chinese pear cultivation is said to be under pressure. Growers emptied the orchards and switched to apples, a market that has problems of its own. Exporters consider pears a product that's too delicate, instead focusing on the domestic market.

US: Red Bartlett losing popularity

In the northwest of the United States, the season starts a few days earlier. Because of the warm spring, the season has been brought forward. In the estimates, the volumes are 2% higher than the five-year average, but 2% lower than last year's harvest. The Bartlett and Starkrimson harvest starts in August, with larger volumes halfway through that month. In September, the harvest of winter varieties d'Anjou, Bartlett and Bosc follows. In the state of Washington, the harvest is estimated to be 20.4 million standard industry boxes. The Red Bartlett is losing popularity among growers and consumers, while the Starkrimson is on the rise.

Australian growers pleased with open market Vietnam

The reopening of the Vietnamese markets was good news for the pear exporters in Australia. Over the past years, the export to Vietnam increased year over year, with 64 tonnes in 2012, 82 tonnes in 2013, and 106 tonnes in the first nine months of 2014. In September of last year, Vietnam closed its borders to Australian pears. Vietnam is an important market for some exporters. Shanghai, Hong Kong and Thailand are other important markets, as are Indonesia, Canada and New Zealand. All in all, the export amounted to 3,317 tonnes, or 5.5 million dollars, in May 2015. For most growers, the harvest season ended in May, with the Packham and William being the most important varieties. Australian organization APAL is, in cooperation with a number of other parties, doing research into the health aspects of pears.

Israel only grows for own market

The pear harvest in Israel started a week or two ago. The top fruit stays within Israeli borders, with some traders importing pears to meet domestic demand. According to one Israeli trader, the consumer prefers the Nashi pear over the Conference. "The Nashi pear is a difficult product. It's a club variety with a high brix, crunchy and juicy."

Every week, FreshPlaza publishes an overview of the market situation of a product in a worldwide context. With these articles, we're aiming to give an idea of a global market that's becoming ever smaller as a result of globalization. Next week, the spotlight is on grapes.