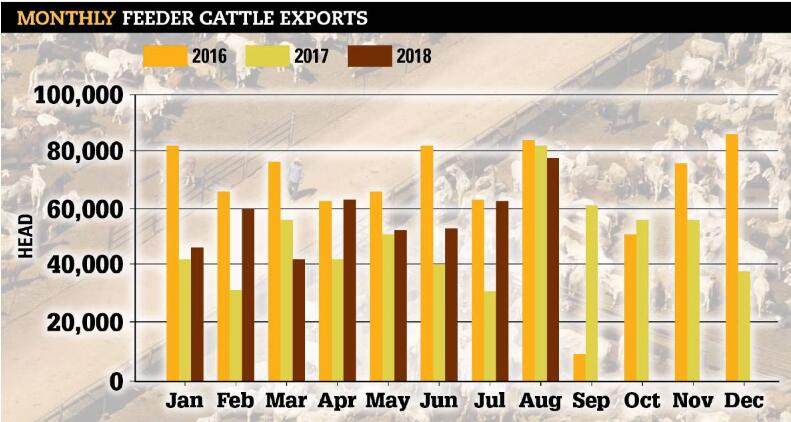

Monthly exports out of Townsville hit a three-year high in August, the latest edition of the industry’s trade summary, Livelink, shows.

At 680,000 head year-to-date, live cattle exports are now travelling 24 per cent above year-ago levels.

Analysts said the Indonesian demand had come from the need for feedlots to restock following big festivals including Eid-al-Adha at the end of August.

The extent of the spike could lead to a degree of oversupply in cattle for slaughter at the end of the year, some said.

The demand coupled with increased supply in Australia on the back of a good wet season last year in the Northern Territory and drought-induced turnoff in Queensland in recent months.

Northern Territory Livestock Exporters Association chief executive officer Will Evans said with pricing sitting around the $3 a kilogram mark and Darwin port numbers up 28 per cent on this time last year, the NT live export season was looking promising.

“If numbers stay strong during the wet season it is looking like finishing up as a good year,” he said.

Having live cattle at the centre of the Indonesia–Australia Comprehensive Economic Partnership Agreement negotiations showed the commitment of both the Australian and Indonesian government to seeing the trade grow, he said.

The industry will also benefit with the shift to a more market-oriented import regime, with permits to be issued automatically and on an annual basis, according to MLA analysts.

Exports of feeder and slaughter cattle to Vietnam for the calendar year-to-August were up 15pc year-on-year.

Mr Evans has just returned from a trade trip to Vietnam and Indonesia and said conversations with both government and business representatives were promising.

“The recognition of the importance of animal welfare and traceability was very much in the minds of those we spoke to,” he said.

“Building a sustainable trade is going to rely on continuously seeking to strengthen the relationships we have with customers in these markets and ensuring they have the knowledge and facilities available to them to grow their businesses in line with the expectations of the Australian industry.”

MLA said opportunistic buying also resulted in a lift in exports to Malaysia and the Philippines for the calendar year-to-August – albeit volumes increased off a low base the year prior.

US still the focus

On the processed side, attention is still firmly on increased cattle supply in the United States and how much downward pressure is likely to be applied to US imported prices as a result.

MLA analysts report beef demand in the US has been very strong through the summer and that has supported cattle prices despite an increase in feedlot inventories.

The futures market also points towards sustained beef demand into next year, they said.

Peak processor group the Australian Meat Industry Council said Australian red meat processors and exporters had diversified product offerings and were increasingly looking to position their product as a premium offering, creating a buffer against the commodity-style product hit hard by these type of supply impacts.

“Exporters have also continued to expand into other markets – diversification is a sound policy in this type of environment,” AMIC’s Patrick Hutchinson said.

“We’ve seen a major redirection in some of the key grinding beef categories that are shipped to the US over the last few years, indicating our exporters are not fully reliant on the one market.”

In, 2014-5, Australia exported 141,298 tonnes of 85CL (chemical lean) beef. More than half of that was sent to the US.

This past financial year, exports of 85CL beef had declined to 94,911 tonnes, with the volume to Japan growing and the US volume dropping to 30,965 tonnes.

“Some categories, like 90CL and 95CL, remain dominated by trade to the US, but these remain well placed to complement the fattier trim from US lot fed beef, to meet the requirements of the booming burger trade,” Mr Hutchinson said.