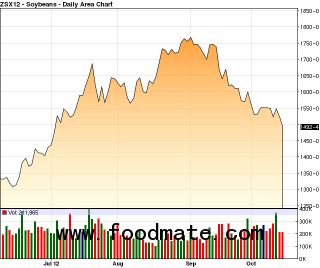

Chicago Board of Trade November soybeans fell 30 cents, or 2%, to $14.92 1/2 a bushel, a more than three-month closing low.

Grain and soybean futures all fell Monday as managed funds sold futures, traders said. Managed funds recently continued to trim their net positions betting on higher wheat, corn and soybean prices, according to regulatory data issued Friday. That trend appeared to continue Monday.

For soybeans, the selling pressure came largely from improved expectations for soy crops in the U.S. and South America. Anecdotal yield reports from U.S. farmers harvesting crops in recent weeks have been better than analysts once feared, and the U.S. Department of Agriculture last week raised its forecast for domestic production this year by more than analysts had expected.

Rain in Brazil over the weekend eased worries about dryness as farmers there plant a new soy crop. The weekend rains, combined with a likely increase in rains this week in northwestern areas, "should significantly improve soil moisture for corn and soybean germination and early growth," private forecaster MDA EarthSat Weather said in a weather note Monday.

Technical signals for soybeans are also weak, weighing on prices.

Despite many managed funds exiting their bets on higher soybean prices, funds still have a sizable net long position that gives more room for soybean prices potentially to fall, said Rich Feltes, vice president of research for R.J. O'Brien.

The next level of support for soybeans on technical charts is around $14.50 a bushel, Mr. Feltes said. "That is probably where these markets are going to gravitate to."

Soybeans dragged corn and wheat futures lower as well, as funds sold all three commodities. But corn was also pressured by negative technical signals and worries about high prices for the grain having curbed demand.

After two consecutive sessions of declines, corn futures on Monday settled around the same level they saw before a jump on Thursday last week, when the USDA forecast tighter domestic corn inventories than traders had expected. Traders saw corn's inability to hold onto the gains late last week as a negative technical signal.

December corn fell 15 1/2 cents, or 2.1%, to $7.37 1/4 a bushel.

Wheat futures received extra pressure from concerns about weak export demand. Wheat traders worry that U.S. supplies remain too expensive to be competitive in export markets. Weekly export inspections of wheat reported by the USDA on Monday fell well below analysts' expectations.

CBOT December wheat fell 8 1/2 cents, or 1%, to $8.48 1/4 a bushel. KCBT December wheat fell 9 cents, or 1%, to $8.81 1/4 a bushel. MGEX December wheat fell 3 1/4 cents, or 0.4%, to $9.21 a bushel.