Volumes (in tonnes) and evaluation in season (chart in French)

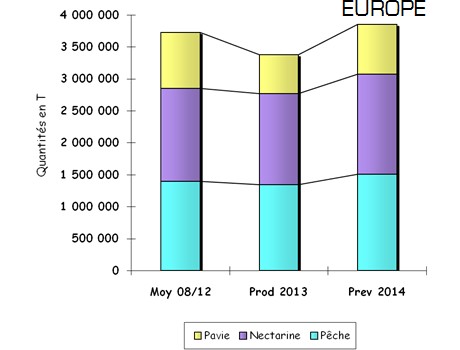

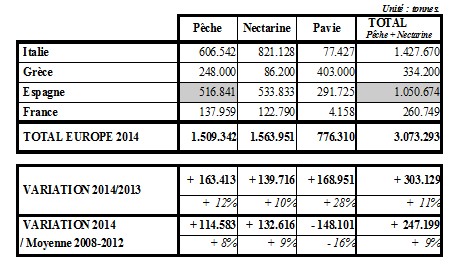

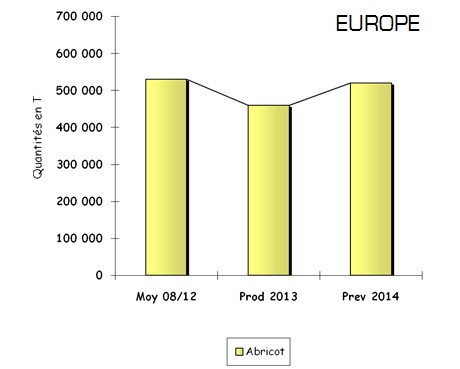

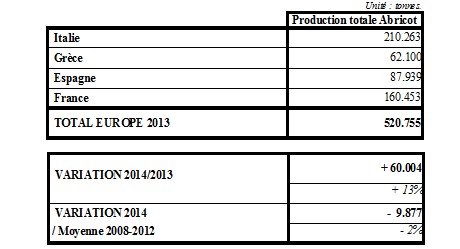

In Europe, peach and nectarine harvest forecasts are 11% higher than in 2013 with over 3 million tons and a 9% growth compared to the 2008-2012 average. 520,000 tons of apricots are expected this season and the harvest should be 13% higher than last year and 2% lower than the 2008-2012 average.

Volumes (in tonnes) and evaluation in season (chart in French)

Italy expects a similar volume of peaches and nectarines to last year (2013 was within the 5-year average and of good quality: 1,404,480 tons in total, of which over half comes from South Italy). Spain and France expect production to be 15% higher than last year (Spain: 907,299 tons and France: 226,885 tons in 2013) whilst Greece expects a 44% increase (2013 was marked by frost and hail with 232,000 tons of production).

Apricot production in Greece is expected to bounce back +47% this year (62,000 tons compared to 42,200 tons last year), catching up with the 15-year average. Apricot production in Italy is expected to increase +11% compared to 2013 to 210,000 tons, but is still -8% compared to the average. Spain expects an 88,000 ton harvest, i.e. 10% less than last year and 8% above the average, with 60,000 tons coming from the Murcia region. France expects a 160,000 ton harvest, i.e. 22% higher than last year and 3% above the 2008-2012 average with main production coming from the Rhone-Alpes region (95,340 tons) followed by the Languedoc-Roussillon (41,540 tons) and P.A.C.A. (23,573 tons).

Flat peaches are popular in Spain with an almost 30% growth compared to 2013 and production beginning on orchards planted between 2010-2012. In Spain there is a decrease in acreage of pome fruit in favour of stone fruit. In the Mediterranean production zones (mainly Murcia), acreage for apricots and nectarines has increased whilst yellow peaches and plums has decreased (due to market demand). Nectarine and peach production acreage in Catalonia has increased 9%. Greece is trying to increase acreage in order to fulfil demand over the summer for varieties that are redder in colour and sweeter.

The financial crisis affects Spain's national market: peach and nectarine consumption dropped 7.7% last year to 4.07kg/capita/year. In France 1,100,000 tons of apples, pears, apricots and peaches come from 'sustainable orchards' following client demand.

Ukraine

Tensions in Ukraine are a concern for Spanish, Italian and Greek operators who rely on export to Russia and Eastern Europe. The current crisis and the EU's economic sanctions towards Russia have affected the exchange rate and buying power at import. If import from these 2 countries decreases there is a risk of saturating the other targeted markets. Other destinations targeted for import are South America and the Middle East, but volume remains inferior to that destined for Eastern Europe over the last 3-5 years.

Season 2013

Over the 2013 season a long and cold winter caused a delay in flowering. Spring temperatures were lower than the season average and harvests were historically late in almost all European production zones. The cold and humid climate during flowering led to lower than normal calibres on many early varieties. These elements led to an offer lower than normal between the start of the season and July. The weather improved at the start of July through until the end of August and the offer was abundant. Prices dropped in mid-July in Spain, followed by Italy and France at the end of August. First half of the season volumes were low but prices correct, and the second half volume was abundant but prices nose-dived (due to an excess offer and problems with the European market). Spain experienced a normal quality for fruit but calibre was lower than average for early varieties with rotting problems due to rain.