re poised to extend into the next decade as West African growers struggle with underachieving farms or switch to more lucrative crops, such as rubber.

re poised to extend into the next decade as West African growers struggle with underachieving farms or switch to more lucrative crops, such as rubber. As worldwide demand increases -- the average Chinese consumer eats only a little more than two candy bars’ worth of chocolate a year -- producers are considering ways to boost grower income and coax higher yields from cocoa farms in Ivory Coast and Ghana. Despite two years of shortages, prices haven’t risen enough to persuade many farmers to stick with cocoa while other crops pay more.

“Cocoa farmers are becoming more aware of the bad deal they’re getting on the cocoa value chain,” said Edward George, head of soft commodities research at Lome, Togo-based lender Ecobank Group. “It takes something quite dramatic to get a farmer who has been cultivating cocoa his entire life to tear up his cocoa plantation and switch to rubber. But you can see a trend is under way.”

Worldwide cocoa demand will outpace production again in the next season that starts Oct. 1, according to a Bloomberg survey of five analysts and traders. The deficit is expected to grow ninefold to 1 million metric tons by 2020, which would equal about one-quarter of global output if growers maintain the current rate of production, said Zurich-based Barry Callebaut AG, citing an industrywide forecast. How to satisfy global demand will be a topic discussed at the World Cocoa Conference, which starts June 9 in Amsterdam.

Sustainable Farming

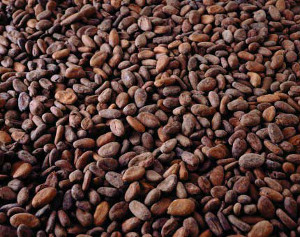

Part of the problem is unrealized potential, said Damien Thouvenel, a cocoa trader for Sucres et Denrees SA, or Sucden, in Paris. Growers in Ivory Coast, which, combined with neighboring Ghana, is the source of 55% of the world’s cocoa, harvest an average of 400 kilograms (882 pounds) of beans per hectare (2.5 acres) while a farm that’s well-managed with fertilizers and pesticides can yield up to 1.5 tons per hectare, Thouvenel said.

To address this, 12 of the world’s largest chocolate and cocoa companies, including Barry Callebaut, Ferrero SPA, Hershey Co., Mondelez International Inc., Mars Inc., Cargill Inc. and Nestle SA (NESN), signed an agreement with the Ivorian government in Abidjan on May 20 to “accelerate actions to make cocoa farming in the country sustainable,” according to a statement on the website of the World Cocoa Foundation, which will coordinate strategy.

Action Plan

Under the CocoaAction plan, as it’s called, at least 200,000 farmers in Ivory Coast and 100,000 farmers in Ghana will get improved planting materials, fertilizers and training by 2020.

Regulators in Ivory Coast -- the Conseil Cafe-Cacao, created in 2011 -- and the Ghana Cocoa Board, also called Cocobod, determine the fixed compensation paid to growers, or farmgate price, to ensure fairness and spur production.

The Ivorian government gave cocoa farmers a raise in 2013-14 as futures prices in London climbed almost 20% in the seven months through Oct. 1, when the season started. Under the new regime, growers are guaranteed at least 60% of the international price. That compares with 40% to 50%, and sometimes as low as 20 percent, before the reforms, according to George of Ecobank. Ghanaian farmers didn’t get the same raise. The country kept the producer price at 3,392 cedis ($1,134) a ton.

‘Too Low’

“Cocoa prices have been too low for too long and today the farmer in Ivory Coast, Ghana or Indonesia is facing other alternatives like palm oil or rubber,” said Thouvenel of Sucden. “Prices will have to trade higher to stimulate production.”

Ibrahim Cisse, who farms nine hectares in western Ivory Coast, said he started devoting six of those hectares to rubber four years ago because he could make more money that way.

“Instead of losing my time and killing myself to try to fix my cocoa trees, I preferred switching to rubber,” Cisse said by phone from the town of Tai. Since it takes seven years for rubber to grow, Cisse said he expects his first harvest to be in the 2016-17 season.

Ivorian cocoa farmers were paid 990 CFA francs ($2.05) per kilogram in 2009-10 as futures on NYSE Liffe surged 31 percent in the three months before the start of the season. That helped boost global cocoa production to a record 4.312 million tons the following year, according to data from the London-based International Cocoa Organization. By comparison, farmers received on average 550 CFA francs in the nine seasons before the reform, according to ICCO data.

Farmer Prices

Even if the farmgate price is increased next season from the current 750 CFA francs, which is likely because futures prices have risen 28 percent in the past year, it wouldn’t immediately translate into higher output.

“The farmer needs to have the money in his pocket before he can make the further investment to produce more cocoa,” said Jonathan Parkman, co-head of agriculture at Marex Financial Ltd. in London.

Cisse switching to rubber is part of a trend. Ivory Coast has more than doubled output in the last decade to an estimated 290,042 tons in 2012-13 to become Africa’s biggest producer and exporter, according to an April 14 Ecobank report.

‘Easier Crop’

“Rubber is a much easier crop to look after,” George said. It requires less fertilizer and pesticide than cocoa and is harvested monthly, providing a more regular income. Big companies using rubber, most of which buy directly from farmers, are trying to expand production by attracting more cocoa producers, George said.

The strategy may be working too well. Rubber is in a fourth year of global surplus, and futures prices on the Tokyo Commodity Exchange have lost 62% since their record in February 2011. Cocoa prices in London, by comparison, fell about 16% in the same period.

World demand for chocolate confectionery will grow at an average annual rate of 2.1% through 2018, and higher in Asia, according to forecasts from Euromonitor International, especially if those two candy bars a year prove insufficient for the average Chinese consumer.

“If the slump in rubber prices continues and if cocoa prices go up, who knows?” George said. “Maybe we could see the rubber farmers coming back into cocoa.”