For chicken meat the global average is a little over 13 kg per person per year.

Since 2000 global growth in turkey production at around 0.7 per cent per year has not kept pace the annual average increase in the population of around 1.2 per cent.

Hence, in theory, the average global consumption of turkey meat has slipped a shade from 0.83kg to 0.77kg.

However, this is a misleading calculation as around three-quarters of the world’s population do not have access to turkey meat.

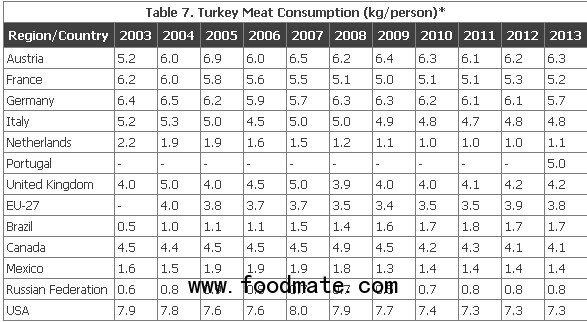

A more realistic picture of consumption in specific countries is presented in Table 7 and Figure 3, the average in 2013 ranging from a little less than 1kg in the Russian Federation to a high of 7.3kg in the USA.

Sadly, with the notable exceptions of Brazil and Austria, the uptake in the other countries listed was lower than ten years earlier.

* These are estimates of the supplies available for consumption, - no data

Source: AVEC annual reports

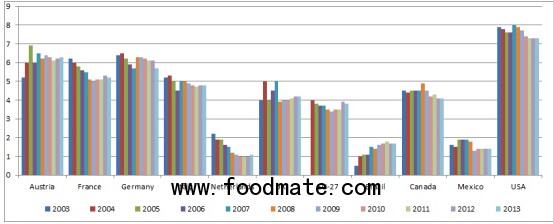

Figure 3. In most countries people are eating less turkey (kg per person per year)

American consumption of turkey is the highest in the world as the industry has developed it from a single product holiday-oriented market to a year-round range of diversified and value-added products.

Turkey meat is increasingly being marketed in a variety of ways with the emphasis latterly being placed on targeting health-conscious consumers.

Also, during the past decade or so there has been significant growth in the use of ground turkey as a lower fat substitute for ground beef. In 2014 consumption per person slipped a little below 7.2kg. While an improvement is forecast to 7.3kg in 2015 and further to 7.6kg per person in 2016, this will be well short of the 2007 record of 8.0kg.

Uptake in Brazil increased from 0.5kg in 2003 to 1.7kg in 2013.

However, a cutback in production in 2014 led to higher turkey prices making it less competitive against alternative proteins, particularly broiler products.

This had a negative impact on demand, so it looks as though consumption per person will have declined in that year.

This slowdown in domestic demand is considered to be the main constraint affecting future production growth since exports are projected to increase.

Consumption in the EU dropped from 4.0kg to 3.4kg per person between 2000 and 2009 but then increased to around 3.8-3.9kg.

As these markets are mature it is difficult to see uptake rising above the 4kg per person level.

This trend is mirrored in the data for France where, having declined from 6.2kg to 5.0kg in 2009, consumption has since recovered a little to 5.2kg per person.

Although consumption in Canada can be described as “flat” for most of the review period, more recently the industry has been able to take advantage of the situation in red meats where supplies are “tight” and prices have hit record levels.

Overall turkey supplies are controlled by a Supply Management scheme which clearly controls growth. Nevertheless, it is generally considered that uptake this year will be similar to 2014 at around the 4.1kg mark.

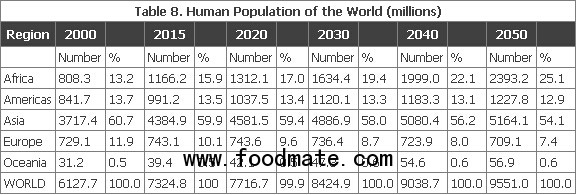

Currently, just 24 per cent of the world’s population is found in the primarily developed economies of the Americas and Europe.

By 2030 this figure will have declined to 22 per cent and further to 20 per cent by 2050 (Table 8).

Compared with today, while there will be almost 237 million more people to feed in the Americas in 2050, in Europe there will be 34 million less!

Between now and 2050 the world population will increase by nearly 2,230 million of which almost 1,230 million will be in Africa, as this region will then account for 25 per cent of the total.

A further 780 million extra mouths will be in Asia, which with Africa will represent nearly 80 per cent of the world total.

Sadly, few of the countries in either of these two regions currently grow significant numbers of turkeys.