ine Brokerage reports that there isn’t enough Cabernet Sauvignon being produced in Sonoma County to meet current demand.

ine Brokerage reports that there isn’t enough Cabernet Sauvignon being produced in Sonoma County to meet current demand.“Despite back-to-back large harvests, demand for both grapes and wines in bulk has remained strong, reflecting strong consumer demand for Cabernet Sauvignon at premium price points,” said Steve Fredricks, president of Turrentine Brokerage.

“Growers in Sonoma County are focused on Pinot Noir and Chardonnay, so they’re not planting Cabernet,” he added, even though there’s demand for Cabernet—particularly from the Alexander, Dry Creek and Sonoma valleys.

The shortage is forcing wineries including major brands to look to other areas—notably Lake, Mendocino and other North Coast regions.

The average price per ton of Cabernet Sauvignon from District 3 (Sonoma and Marin counties) was $2,469 in 2013, according to the California Crush Report. That was almost flat with the $2,417 per ton reported in 2000.

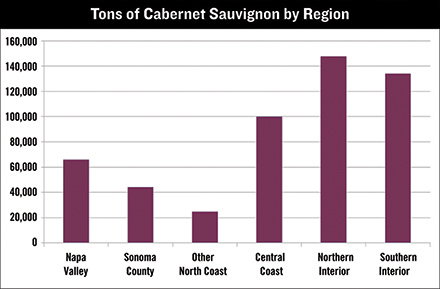

The district provided 44,256 tons of Cabernet Sauvignon in 2013, up from 32,772 in 2000. 2012 was a record year with 46,770 tons. The five-year average was 38,100.

Sonoma County Vintners estimate the number of acres of Cabernet Sauvignon vines is 12,600, which would be an average yield of 3.5 tons per acre in 2013.

Though smaller than the crop in Napa County, Sonoma’s Cabernet tonnage is considerably larger than those in other parts of California’s North Coast American Viticultural Area.

Strong demand and increasing prices will stimulate interest in planting Cabernet Sauvignon in Sonoma County, but a shortage of appropriate sites, environmental regulations and high costs will moderate the response.

Fredricks noted that the few additions of Cabernet vines that are occurring are coming mostly from grafting over Merlot and Chardonnay in areas suitable for Cabernet.

He also sees wineries turning to Paso Robles, Lodi, south Monterey County and Washington, though Paso is undergoing a planting moratorium in dry areas.

He reported that in 2013, the wave of Cabernet Sauvignon planting shifted from the San Joaquin Valley to the Central Coast, primarily Paso Robles and southern Monterey County.

“Sonoma County brands will need to be very focused on maintaining or elevating quality and ratings as they try to justify price increases necessitated by increasing grape prices,” he added.

Turrentine’s warning comes from the next issue of The Turrentine Outlook: Forecasts and Strategies for a Competitive Advantage. Recently expanded to include additional varieties, this publication draws upon Turrentine Brokerage’s experience and unique, supply-side data to analyze changes in supply and demand for eight key grape varieties in the major growing regions across California and internationally. As growers, grape buyers, brand owners and financiers scramble to adjust their strategies in the face of drought, two large harvests in a row, growing case-good sales in certain price points and renewed planting activity, the report also suggests strategy options for a competitive advantage.

Other highlights from the report include:

• Demand is down for Lodi Zinfandel to be used for red wine production due to strong inventories from the 2012 and 2013 harvests and the increase in supply of other red wines for blending.

• The amount of bulk Central Coast Pinot Noir wine actively for sale has more than doubled during the past year, and prices have moderated following the 2013 harvest, which set a record for tons crushed in both District 7 (Monterey County) and District 8 (San Luis Obispo and Monterey counties).

• A larger percentage of Lodi Chardonnay is already under contract for 2014, and few tons are actively for sale.

Turrentine Brokerage was founded in 1973 and specializes in wine grapes and bulk wine from the major growing areas of the world. Working with thousands of wineries worldwide, and with over 2,000 growers, it has negotiated transactions valued at more than $2 billion during the past decade.