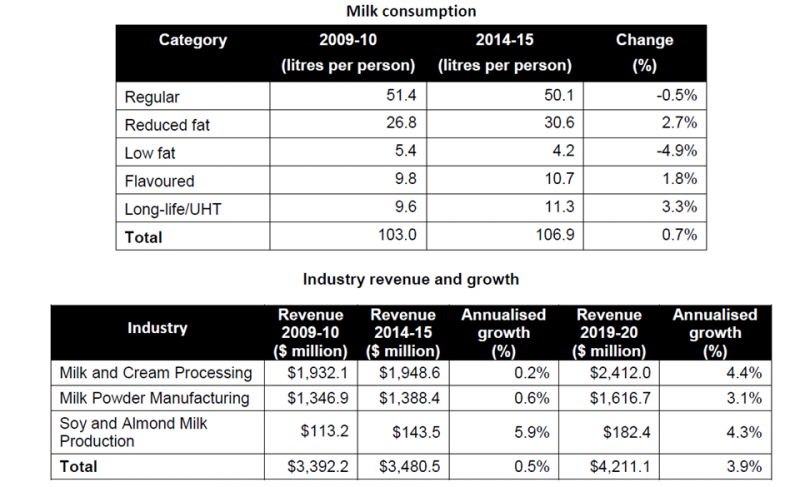

-20, revenue across all categories is forecast to grow by an annualised 3.9 percent.

-20, revenue across all categories is forecast to grow by an annualised 3.9 percent.“Increasing consumer health consciousness, the continuing promotion of the benefits of milk and dairy, and the diversification of tastes as new milk alternatives emerge are all driving a gradual increase in milk consumption and revenue for the industry,” said IBISWorld Australia general manager, Daniel Ruthven.

A growing demand for health food products that are perceived to be low in fat while also offering higher protein levels, essential minerals and iron has driven the growth for dairy alternatives including soy and almond milks.

The soy and almond milk production industry posted annualised growth of 5.9 percent between 2009-10 and 2014-15. Above average growth of an annualised 4.3 percent is expected through 2019-20.

"While traditional dairy products are high in calcium, they are also high in cholesterol. Soy milk, almond milk and other plant-based dairy alternatives are typically protein-rich and low in fat and sodium, making them appealing to health-conscious Australians," said Ruthven.

Over the next five years, new investment capital is expected to benefit the milk and cream processing industries – which in recent times has struggled due to adverse weather – with the sectors expected to enjoy revenue growth of an annualised 4.4 percent to reach more than $2.4 billion in 2019-20.

Exports

Another industry at the mercy of the weather is milk powder processing, however strong export demand has kept the industry buoyant and increased the price premium for Australian milk powders overseas. IBISWorld expects that 70 to 75 percent of Australian milk powder is bound for overseas markets, with revenue forecast to jump by an annualised 3.1 percent over the next five years to reach $1.6 billion in 2019-20.

Australian producers are expected to continue to target growing overseas markets, with exports including fresh, long life and dehydrated milk worth more than $38 billion to the Australian economy per annum.

"Australian dairy farmers typically produce far in excess of our nation’s needs. Fresh milk has largely been unsuitable for export, as it has a short shelf life, but we are increasingly seeing examples of milk being airfreighted to Asian markets. Traditionally, fresh milk has been processed to make cheese, or dehydrated to make milk powder," said Ruthven.

"The growing demand for quality dairy products, including milk, in Asia has been most recently demonstrated with initial shipments of fast-tracked fresh milk to China. Since early 2014, dairy co-op Norco has transported drinking milk to Chinese consumers within seven days via airfreight. This is a remarkable development for the just-in-time model, particularly considering that it previously took 21 days for milk products to pass Chinese quarantine.”

Free trade agreements with Korea and Japan are expected to increase demand for Australian dairy products, and IBISWorld expects increasingly strong demand from the top four foreign markets: China, Singapore, Indonesia and Malaysia.

"Further free trade agreements, including the Trans-Pacific Partnership Agreement and the bilateral agreement with China, are expected to boost Australia's exports of milk and milk products.

"Despite significant progress being made with China, the country maintains substantial trade barriers. It has demonstrated a willingness to negotiate on reducing some tariffs following a 2008 trade agreement with the world's largest dairy exporter, New Zealand. A similar agreement between Australia and China could hold the promise of an incredibly valuable – and increasingly wealthy – market for our exporting dairy farmers," Ruthven said.