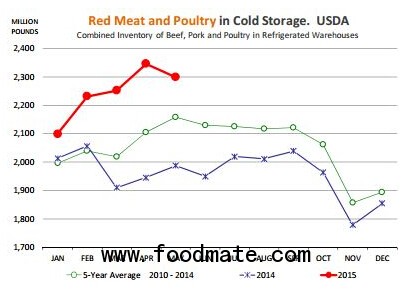

That total is 15.6 per cent higher than a year ago and 6.6 per cent higher than the five year average.

Inventories were down 2 per cent from the previous month, when normally stocks increase slightly during this time of year.

Higher pork and chicken production and larger imports have all contributed to the surge in cold storage inventories.

At this point we view the large stocks as generally bearish for meat prices, particularly for pork and chicken. Production for these two species will remain notably higher than year ago levels into the summer and fall.

Exports have been particularly problematic for chicken dark meat and that continues to be reflected in the cold storage numbers.

Below are some of the highlights from the USDA's Cold Storage report:

Beef: Inventories of boneless and bone-in beef in cold storage at the end of May were 468.5 million pounds, 24.1 per cent higher than a year ago and 8 per cent higher than the five year average.

Beef inventories were down 3 per cent compared to the previous month, which is a normal seasonal decline. Given high beef prices, end users are maintaining larger inventory hedges and thus we don’t see the larger stocks as particularly bearish for this market.

There is more imported beef coming, which has also helped bolster inventories.

We think the spread between domestic and imported will narrow in the coming weeks but it will stay relatively large through fall.

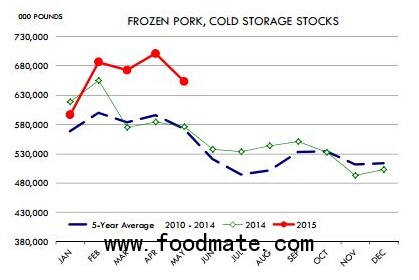

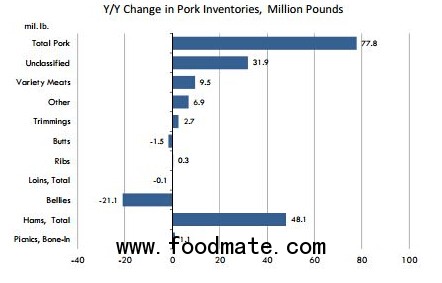

Pork: Total pork in cold storage as of May 31st was 653.6 million pounds, 13.5 per cent higher than a year ago and 14.1 per cent higher than the five year average.

Pork inventories declined 7 per cent from the previous month, evidence that sales have improved. However, current stocks remain burdensome.

The most bearish number in the report was the sharp increase in ham inventories, which at 158.1 million pounds were 43.8 per cent higher than a year ago and 34.4 per cent higher than the five year average.

The pork cutout will need stronger ham prices if it is to rally in the next two months. We view current ham stocks as bearish for the pork complex overall.

Pork belly inventories are now under year ago levels, which should help support prices for this item going into the summer, when retail demand improves.

Inventories of pork trimmings, which were running heavy in the last three months, have stabilised and currently are just 5.7 per cent higher than a year ago and the same as the five year average.

Chicken: Inventories of all chicken were 738.3 million pounds, 20.6 per cent higher than a year ago and 10.6 per cent higher than the five year average.

Inventories declined from the previous month but they remain burdensome.

Chicken production is running significantly above year ago levels and heavy inventories will continue to add to the bearish tone in the chicken market.