Citrus is one of the main categories produced in SA, with 1.4 million tonnes of oranges produced accounting for 36% of total fruit production. However, growth in smaller volume categories such as grapes is also strong. Grapes account for 8% of production in SA, but volumes have grown by 26% over the last ten years, reaching volumes of 300,000 tonnes in the 2012/2013 season.

Despite the relatively small percentage, in export terms, grapes have the second largest volume of shipments, accounting for 22% of fruit exports from SA. These grapes are shipped across the globe during the main export season, from early November – May. Over the last ten years, the main countries that SA has supplied with grapes has broadly stayed the same. However, the volumes supplied between these key destinations have shifted considerably.

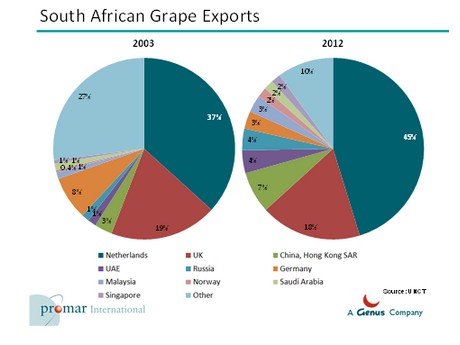

The Netherlands is still the leading destination for SA grape exports. In 2012, they received 119,000 tonnes, accounting for 45% of total grape exports from SA. This compares to 37% in 2003. Over the same period, exports to the UK (although growing), fell in their total export share. In 2003, 37,870 tonnes were exported directly to the UK, accounting for 19% of total exports, however in 2012, this figure had altered, showing an increase to 47,400 tonnes of grapes, but provided a total export share of 18%.

Within the other top five countries which SA supplies its grapes to, China, the UAE, and Russia have seen their imports increase in total by over 200% each over the last ten years. SA exports to China have grown at a strong Compound Annual Growth Rate (CAGR) of 13%, with volumes of 19,550 tonnes. In 2012, they accounted for 7% of total exports, compared with just 3% in 2003. Exports to the UAE and Russia now account for 2% each of SA’s grape exports, although volumes are still relatively low at 10,700 tonnes and 10,200 tonnes respectively, but the strong CAGR’s of 15% in the UAE and 16% in Russia indicate increasingly important potential for the markets in the future.

Whilst some leading countries have seen growth in their SA grape supplies, Germany has seen a fall in both direct volume and share. In 2012, volumes had fallen by 46% from 2003 to 8,300 tonnes, accounting for 3% of SA supplies – a fall from the overall 8% share in 2003.

These long term trends are overall consistent with the more immediate short term trends affecting the sector. In recent weeks, exports are down year on year with those supplied to Northern Europe seeing the biggest fall, compared to shipments to the Middle East. SA is in a prime position to develop its export portfolio. Of the top ten supply countries, 40% are European destinations, 40% are Asian countries and the remaining 20% are located in the Middle East. This ‘spread’ means that risk does not need to be placed upon the ever changing demands and market conditions of one single country or market. Instead, not least, SA grape growers and exporters can focus on their main priority which is maintaining the high quality standards of SA grapes that are recognised across the globe.

Promar International has been conducting work in and for South African clients for a number of years. Projects have ranged from weekly grape price tracking analyses, to up to date monthly dashboard reports on the global fruit sector and market prioritisation studies across the EU, Asia and the Middle East.