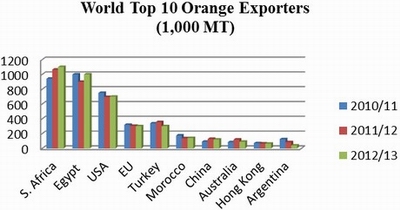

In MY2012/2013, the European Union, Russia, Saudi Arabia, Ukraine, the United Arab Emirates and Iraq were Egypt’s top export markets and post foresees no major export destination changes for this new marketing year. South Africa is Egypt’s main export competitor in the leading export markets. Other competitors include Turkey, Spain, Morocco, the United States, China, Australia, and Argentina.