Ecuador is currently the world's largest banana exporter and, in the past, it used to lead the Chinese market, as it exported more than 300,000 cases of bananas a week to the Chinese market.

"Exports in the 80s began thanks to the visionary effort of Segundo Wong, primarily in the form of barter. He was very successful but we began to lose market share, not because of the fruit's quality but because of the costs, the lack of shipping logistics, and the cheap fruit from the Philippines and other producers. It was very difficult for us to compete and the companies with the biggest share stopped sending fruit," recalled Eduardo.

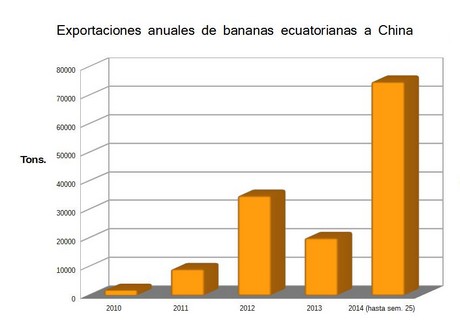

"We were sending a very small quantity to China, but in recent years, thanks to a rise in consumption, the conflict with the Philippines and the drop in production in countries such as Colombia, Costa Rica and the Ivory Coast, we have greatly increased the volume of exports," he said.

Conflict over the South China Sea

The tension due to the territorial dispute of the South Sea between China and the Philippines, the second largest exporter of bananas in the world, has increased over the years, which has brought complications and impediments to trade between the countries of the region; a situation that, at first sight, seems favourable for Ecuadorian exporters.

"We have increased the volume of exports and a large number of major reputable importers from China are looking to import larger amounts; not only because of the conflict with the Philippines, but also because of our quality. "

"Nevertheless"

There are several factors affecting the competitiveness of Ecuador in the Chinese market.

Ecuadorian bananas require 35 days to arrive at the port of Shanghai, while the bananas from the Philippines only require 3 to 5 days. In addition, Ecuador must pay 10% in tariffs to enter the Chinese market, plus a tax for crossing the Panama Canal, while its Asian competitor is exempt from any fees.

"Ecuador's working conditions and workers' wages are much higher than in most other producing countries, which entails a higher cost of production," says Ledesma García.

"Nevertheless, we are selling more and more bananas to China. This year we exported, on average, 217,000 boxes a week, and up to week 25 we had shipped about 4.127 million boxes."

Looking to the future

Even though production is at its highest level since 2011 and the level of exports to China is booming, the executive director of the AEBE stressed the need to focus and improve productivity.

"Currently, we are getting about 1,700 boxes per hectare. We must improve and exceed the 2,000 boxes, "said Ledesma, who added that," we must also improve logistics with China and reduce transport time to just 25 days by hiring a loose cargo."

If carried out, these improvements could increase the presence of Ecuadorian crops on Chinese soil and, in turn, would make them more resilient to a possible future resolution of the conflict between Chinese and Filipinos.

Finally, when asked about what he wished for the future of Ecuadorian banana exports, Ledesma García replied, "I want us to be exporting 400 million boxes, which would cause many countries to stop producing bananas."