That’s because the brand is pulling in more than $230 million annually, and is increasing sales at nearly 20 percent per year, in channels measured by Symphony IRI Group, a Chicago-based research firm (Supermarket, Drug, C-Store and Mass Market excluding Wal-Mart). But Smartwater hasn’t just become a four-channel phenomenon – it’s also become the glamour brand of the Coke water portfolio, getting good slots at airports, vending, foodservice, and high-gloss events.

That’s because the brand is pulling in more than $230 million annually, and is increasing sales at nearly 20 percent per year, in channels measured by Symphony IRI Group, a Chicago-based research firm (Supermarket, Drug, C-Store and Mass Market excluding Wal-Mart). But Smartwater hasn’t just become a four-channel phenomenon – it’s also become the glamour brand of the Coke water portfolio, getting good slots at airports, vending, foodservice, and high-gloss events.That kind of growth couldn’t go unnoticed at Nestle Waters North America, a company so water-focused that it has taken the category – once regarded as such a simple product that it didn’t even need to be sold in packages — and divided it into a number of need states with products and price points to match.

All of those need states were on display at the recent National Association of Convenience Stores show, where NWNA sliced and diced its water brands to provide equal weight to developing and established fizzy brands San Pellegrino and Perrier, to regional brands like Poland Spring and commodity priced Nestle Pure Life, as well as the company’s burgeoning tea portfolio.

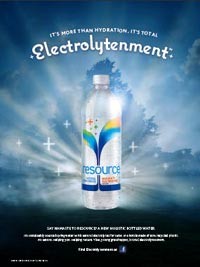

Nestle doesn’t take incursions onto its watery turf lightly, so also getting strong play at the NWNA booth was a relative newcomer: Resource. The company has tasked a pair of branding aces (pulling them in from runaway success Pure Life and stalwart eco-brand Keeper Springs) with the unenviable chore of establishing Nestle as a player in the Smartwater crowd, and they are using Resource (labeled with a Smartwater-like lowercase “r”) as the brand to do it.

“I don’t think anyone was upset about the growth of Smartwater,” said Larry Cooper, a senior marketing manager working on the Resource project. “But it became apparent that this was a need state that was a ripe opportunity – and that need state became apparent by seeing the velocity” of Smartwater.

Hence, Resource — like Smartwater, the brand is electrolyte enhanced, super-purified spring water, and comes in a slope-shouldered capsule-shaped bottle, only this one has an eco-credible edge, made with 50 percent recycled material (and headed for 100 percent next year, according to Cooper).

Resource launched in Southern California recently and is now in 90 percent of the company’s chain accounts in convenience, grocery, and natural channels, according to Joe Wiggetman, who is Nestle’s general manager for Resource and Keeper Springs brands. The company is taking it into broader distribution slowly, but is in the process of selling it into chains in those classes of trade on a national level for the next year.

Still, the idea is to stage it channel by channel – if Resource isn’t capable of growing the category that Smartwater pioneered, the company wants to make its mistakes quietly. But the expectation is that NWNA’s vaunted efficiency will help Resource provide a margin-efficient alternative to older, more expensive-to-produce bottle brands like Evian and Fiji.

The cost structure behind Resource, according to Cooper, allows it to be sold for between $4 and $6 cheaper per case – the same kind of cost structure that allowed NWNA to come out ahead in the pricing wars that drove Coke’s Dasani and Pepsi’s Aquafina to unprofitable commodity status in the late 2000s.

That doesn’t mean that Coke is the target here, though.

“Smartwater is going to continue to grow,” Cooper said. “We don’t mind that — we should have, to complement our premium and value brands, a higher-end complement as well.”