The world's largest beverage company said on Thursday that Steve Cahillane, head of all Coca-Cola operations in the Americas, would leave the company as part of a major organizational shakeup.

That has put Sandy Douglas, a previous head of the North American operation and currently global chief customer officer, in the running for the top job when 61-year-old Kent retires, analysts said.

A chief customer officer typically runs strategy to maximize customer acquisition, retention and profitability.

Coke said it would split its North American businesses into separate units - one for bottling and another for branding and marketing, the latter headed by Douglas.

Cahillane has long been considered Kent's heir apparent.

Coke said only that he was leaving to "pursue other opportunities."

"We have previously believed Cahillane to be a strong CEO-successor, but given the sudden and unexpected nature of his departure announcement, we can't help but wonder what happened?," Wells Fargo analyst Bonnie Herzog wrote in a note.

Cahillane joined Coke from Coca-Cola Enterprises Inc (CCE.N) when the company bought CCE's North American operations in 2010 and created the Coca-Cola Refreshments division.

Coca-Cola Enterprises, now Coke's bottler in Western Europe, was Coke's main U.S. bottler at the time.

He became head of Coca-Cola Americas, the company's North American and Latin American operations, in 2012.

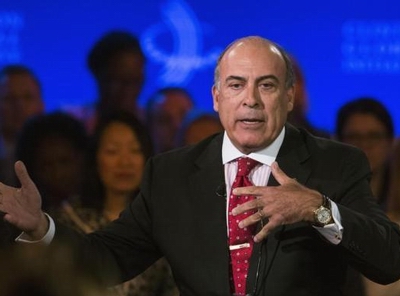

"Under Steve's leadership, our North America business delivered several consecutive quarters of volume and value share gains, despite operating in a very difficult economic environment the past three years," Kent said in a statement.

Coca-Cola generates almost 60 percent of its revenue from international markets and nearly 70 percent from soft drinks.

But in the United States, soda sales have been declining for years as customers choose healthier options such as fruit juices and organic milk.

Coke brands include Dasani mineral water and Minute Maid juices but it faces much more competition in these markets.

The company said its Coca-Cola Refreshments bottling business will become part of the Bottling Investment Group (BIG), which houses the company's bottling operations outside North America. It will be headed by Paul Mulligan, who has been the regional director of BIG in Japan and Latin America.

The company's Latin American operations will be merged with its international operations.

JP Morgan analyst John Faucher said the implications of Coke's management shake-up and organizational changes were difficult to assess and he kept his "neutral" rating on the stock.

Coca-Cola's shares were up 0.6 percent at $39.43 in midday trading. They have risen 9 percent this year, underperforming the broader S&P 500 .SPX, which has risen 24.5 percent.